A volume bot solana is a tool that leverages computers to quickly buy and sell tokens on the Solana blockchain. By using a volume bot solana, you can make a token appear more active by increasing the number of trades. On-chain data reveals that these bots can account for up to 80% of trading activity for certain Solana meme coins. This increased activity makes the coins look popular and attracts more traders’ attention.

What Is a Solana Volume Bot?

A solana volume bot is a computer program that helps make a token look busier on the Solana blockchain. It does this by buying and selling tokens very quickly in small amounts. These trades happen on places like raydium, Orca, or Pumpswap. The bot links to your Solana wallet and talks to DEX smart contracts. Solana’s fast speed and low fees let the bot do thousands of trades without spending much money.

You can tell the bot how much to buy or sell, how often to trade, and how many wallets to use. Some bots let you pick slow, medium, or fast trading. The bot uses many wallets to make the trades look real. This makes your token seem more popular on sites like raydium.

Did you know? The top three MEV bots on Solana now have over 60,000 WSOL. This number has grown a lot since November 2024. More people are using these bots to boost trading volume. Because of this, swap transactions and total swap volume on Solana have gone up. These bots are now a big part of the Solana world.

A solana volume bot can help your token get noticed. When trading volume goes up, your token might show up higher on data sites. This can bring in more traders and investors. You can also use the bot to see how your token does with more trades.

How It Differs from Other Bots?

You might wonder how a solana volume bot is not the same as other bots like a market maker bot or a copy trading bot. Each bot has its own job and special features.

| Bot Type | Main Purpose | How It Works | Example Platform |

|---|---|---|---|

| Solana Volume Bot | Increase trading volume and visibility | Rapid buy/sell cycles, multi-wallet, DEX integration | raydium |

| Market Maker Bot | Provide liquidity, reduce price gaps | Places limit orders, manages order books | raydium |

| Copy Trading Bot | Mirror trades of successful traders | Follows trades of top wallets, often slower execution | raydium |

A solana volume bot tries to make your token look busy by raising trading volume. It does not try to make money from price changes. It spreads trades across wallets and uses smart timing to seem real. You can change how the bot works to fit what you want.

Other bots, like a market maker bot, help keep prices steady by placing buy and sell orders at different prices. These bots make it easier for people to trade without big price jumps. Copy trading bots let you follow expert traders, but they do not raise trading volume like a solana volume bot.

Some bots, like arbitrage bots, look for price differences between exchanges. They try to make money by buying low on one exchange and selling high on another. These bots can do about 150 orders each minute on Solana DEXs like Phoenix. But many of these trades do not work because of slippage or not enough balance. This can make trading volume look higher than it really is.

Solana volume bots also use smart features. For example, they use AI to change trade speed and size when the market changes. They connect straight to Solana RPC endpoints and talk to DEX smart contracts. This makes them quick and good at their job. In tests, these bots have helped tokens move up in daily DEX rankings, especially on raydium.

Tip: Telegram bots like BONKbot and Trojan make it even easier to use solana volume bots. You can trade fast and change your settings right from your phone.

When you look at a solana volume bot and other bots, you see each one has a different job. If you want to boost your token’s trading volume and get noticed on raydium or other sites, a solana volume bot is the best choice.

How Volume Bot Solana Works?

Automated Buy/Sell Cycles

A solana volume bot does many buy and sell trades by itself. This makes your token look busy. The bot runs on the Solana blockchain, which is very fast and cheap. You can see stats from bots like Solinabot. Solinabot has paid out over 2,900 SOL since February 2025. There are more than 650 real transactions you can check on Telegram. These numbers show that solana volume bots work all the time. The bots use AI to help decide when to buy or sell. They look at the market and act fast. The bots can finish thousands of trades quickly. This makes trading volume go up and makes it look like more people are interested.

Solana’s blockchain lets these bots move very fast. Bots like Bullx Neo watch the market and use smart plans. They can do things like limit orders and stop-losses. You get updates right away on Telegram. This helps you keep your token popular and easy to see.

Note: Solana volume bots can help a project grow fast. Some projects have reached a $1.2 million market cap in just 36 hours. This happens because the bot makes trading look healthy and builds trust.

Here is a table that shows how well these buy and sell cycles work:

| Metric | Value |

|---|---|

| Total User Profit | $79,743,086 |

| Cycles Closed | 47,349,316 |

| Total Deposits | $418,429,395 |

| Monthly Profit % (PNL) | +21% to +31% |

| Average Deal Duration | 15 hours to 9 days |

These numbers show that a solana volume bot can make lots of trades. This helps your token get noticed.

Multiple Wallets and DEX Integration

A volume bot solana does not use just one wallet. It spreads trades across many wallets to look more real. This makes it hard for others to spot the bot. You can pick how many wallets the bot uses. Each wallet can trade on different DEXs like Raydium, Orca, or Pumpswap. This lets the bot find lots of places to trade and do it fast.

Bots use old wallets to make trades look even more real. This helps your token get more attention and keeps the chart looking good. When you use a solana volume bot, you can pick which DEXs to use. The bot connects straight to Solana RPC endpoints and smart contracts. This means it can trade any time without waiting.

- Volume bot solana makes trading look real by:

- Using many wallets for trades.

- Trading on different DEXs at the same time.

- Changing trade size and timing to look human.

This helps your token look popular and can bring in new investors.

24/7 Operation and AI Tools

A solana volume bot works all day and night. You do not need to watch it or trade by hand. The bot uses AI to change how it trades when the market changes. It can change how fast, how much, and when it trades. This makes the trades look natural and keeps your token trending.

Here is a table that shows how good and smart these bots are:

| Metric / Feature | Value / Description |

|---|---|

| Number of Users | Over 45,000 users |

| Volume Generated | $3.2 billion |

| Success Rate | 99.8% |

| System Monitoring | 24/7 continuous monitoring |

| AI Integration | AI-powered trade adaptation |

| Activation | Instant activation |

| Infrastructure | Multi-wallet network simulating real market activity |

| Automation Undetectability | 100% undetectable with human-like patterns |

| Blockchain Platform | Solana (fast, low fees, scalable) |

| Trading Algorithm Quality | Professional-grade trading algorithms |

You can control your solana volume bot from your phone with Telegram. This makes it easy to start, stop, or change settings any time. The bot is almost impossible to spot because it acts like a real person. This keeps your trading safe from being flagged.

Tip: Solana’s fast and cheap trades make it great for bots. You can run a volume bot solana all day without high costs or slow trades.

A solana volume bot helps you boost your token’s trading volume. It keeps your token trending and gets more people to notice it. By using AI, many wallets, and DEX integration, your project can stand out on Solana. Unlike a market maker bot, a solana volume bot makes your token look busy and popular.

Sol Volume Bot Features

Customization and Parameters

You can control many settings when you use a sol volume bot. These bots let you pick how much to trade, how often to buy or sell, and which wallets to use. You can set the speed of trading to slow, medium, or fast. Some bots even let you choose different strategies for different times of day. This helps you match your trading to the market.

- Automated buy and sell orders create organic trading volume.

- Liquidity boosting keeps trading steady and reduces price slippage.

- Customizable strategies let you set your own volume and timing.

- 24/7 automation means you do not have to watch the market all the time.

- Bots help your token trend on DexScreener and get more attention.

Reports show that sol volume bot activity can push daily token volumes up by millions of dollars. You get the power to shape your token’s market presence with just a few clicks.

Undetectability

A sol volume bot uses many wallets and changes its trading patterns. This makes it hard for others to spot bot activity. The bot spreads trades across different wallets and DEXs. It also changes the size and timing of trades to look like real users. You can trust that your trading will blend in with normal market activity. Bots use smart algorithms to avoid detection and keep your project safe from being flagged.

Instant Activation

You do not need to wait to start using a sol volume bot. Most bots offer instant activation. You can connect your wallet and begin trading right away. The bot works on Solana’s fast blockchain, so trades happen in seconds. You can control the bot from your phone or computer. This makes it easy to react to market changes and keep your token active at all times.

Tip: Instant activation and 24/7 automation let you stay ahead in the fast-moving Solana market.

Sol volume bot tools have helped some tokens reach billions in lifetime trading volume. You can use these features to boost your project and keep it trending.

Use Cases and Impact

Boosting Token Visibility

You can use volume bots on solana to make your token stand out. When you run a bot, it buys and sells your token many times. This action increases trading volume and makes your token look busy. On platforms like Pump.fun, bots drive up to 80% of all trades. This means most of the activity you see comes from bots, not real people. When your token appears active, more traders notice it. Bots place buy and sell orders close in price, so the price does not change much. This keeps your token stable and helps it move up on lists like CoinGecko and CoinMarketCap. As more people see your token, you get more holders and more real trades.

Trending on Platforms

You want your token to trend on big platforms. Volume bots help you reach this goal by boosting key numbers. These bots increase trading volume, the number of active orders, and how often trades happen. Platforms like DexScreener and DexTools use these numbers to pick trending tokens. When your token trends, more people see it and want to join. Here is a table that shows how bots can change your token’s stats:

| Metric | Numerical Evidence |

|---|---|

| Trading Volume | Increased by 1000% within 2 hours |

| Holder Count | Jumped from 52 to over 500 |

| Trending Status | Achieved trending on Pump.fun |

| Platform Visibility | Listed automatically on Jupiter Aggregator |

Bots like Smithii Market Maker run buy and sell trades to keep your token active. They use many small trades to look real. You can use this method to get your token noticed fast.

Tip: Trending tokens often get more investors and higher liquidity. Using a bot can help you reach this stage quickly.

Raydium Volume Bot Example

Raydium is one of the most popular DEXs on solana. Many projects use a raydium volume bot to boost their token’s stats. When you use a raydium volume bot, you connect your wallet and set your trading plan. The bot spreads trades across raydium and other solana DEXs. It keeps your token’s chart looking healthy and active. You can see your token move up the raydium trending list as the bot works. The bot also helps your token get listed on other platforms that track raydium data. By using a raydium volume bot, you make your project look strong and attract more real buyers. Many teams choose this tool because it works well with solana’s fast and cheap network.

Here is how bots help tokens trend:

- Bots boost trading volume, active orders, and trade speed on raydium.

- They use micro-trades to keep the flow steady and natural.

- Your token appears in trending lists on raydium, DexScreener, and other sites.

- More traders see your token and join in.

- You can recover your costs as new investors buy your token.

You can use a raydium volume bot to give your project a strong start on solana. This tool helps you build trust and grow your community.

Risks and Ethics

Market Manipulation Concerns

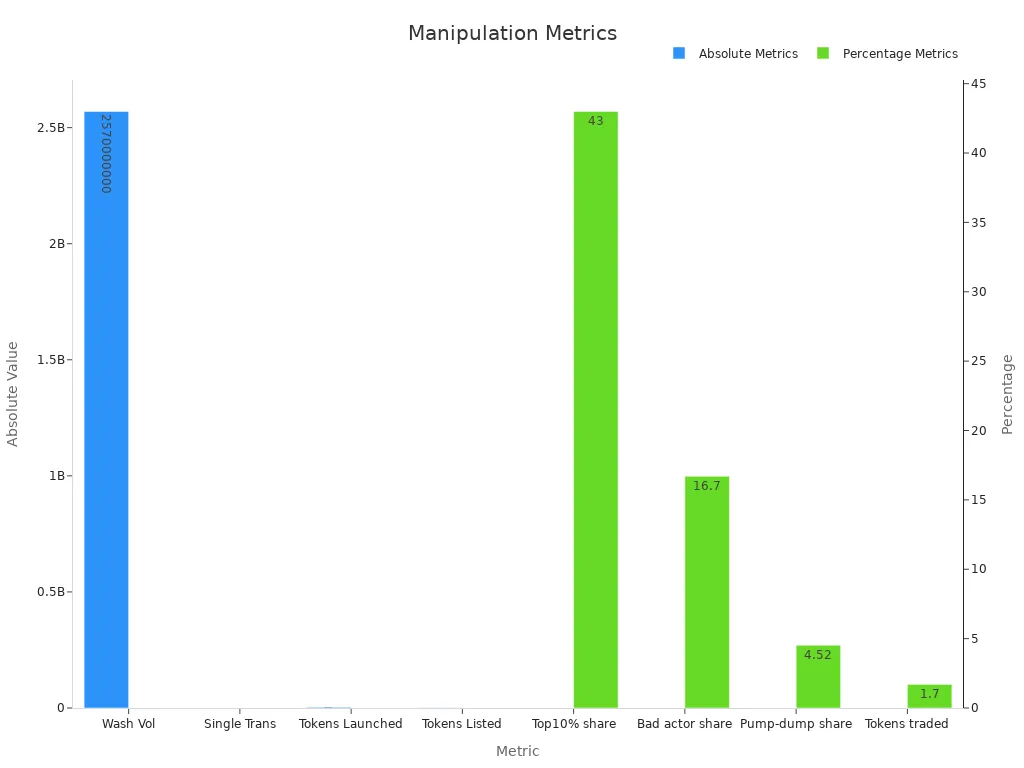

When you use volume bots on solana, there are real risks. These bots can make fake trades. This makes a token look more popular than it really is. New buyers might get tricked and prices can change unfairly. The Mango Markets hack showed how risky this is. Someone used bots to push prices up and borrow too much. This caused a $116 million loss. The person said it was just a “profitable trading strategy.” But it led to legal trouble and hurt trust in solana’s DeFi space.

You can see how bots change launches and trading in this table:

| Metric Description | Numerical Data / Percentage |

|---|---|

| Wallets buying within seconds of LP creation | 4 wallets |

| Percentage of launches with sniper activity | ~84% in first 5 seconds post-launch |

| Proportion of liquidity acquired by bots | >65% of total launch liquidity |

| Tokens dumped by bots within 5 minutes | 30–50% |

| Estimated total affected retail users | ~92,000 in last 6 months |

| Estimated total retail user losses |

Bots can grab most of the liquidity and sell tokens quickly. This leaves regular users with losses. Wash trading and pump-and-dump tricks make it hard to know if a token is really popular.

Investor Perception

You might think high trading volume means a token is safe. But bots can fake these numbers. Many people lose money because they trust the charts. Sniper bots can sell tokens for 100 times profit in days. Regular buyers often lose out. The Chainalysis report says a few people control most of these trades. This makes it hard to find real chances to win.

Note: When bots run the market, prices can crash fast. One token, $HAWK, lost $151,000 and dropped by 90% after a pump-and-dump.

Legal and Platform Risks

Using volume bots on solana can cause legal trouble. The Mango Markets attacker was arrested for market manipulation. Laws now call these actions fraud. If you use bots to fake trades or pump prices, you could break the law. Platforms might ban or block tokens that use bots. After the Mango Markets hack, solana projects changed rules to stop more attacks. You need to follow the rules and be careful. This helps you avoid hurting your project or facing legal problems.

- Key risks to think about:

- Legal trouble for market manipulation or fraud

- Losing user trust and hurting your reputation

- Getting banned or delisted from platforms

- Hard times fixing things after an attack

You should always think about these risks before using a volume bot. Using bots the right way and managing risks helps keep your project and solana safe.

Solana volume bots help you make your token look busy. They let you trade fast and pay low fees. The Solana network is growing bigger every day. But there are some problems you should know about. Sometimes the network can stop working. You might need to pay a lot for good computers. Bots can also make fake trading numbers.

| Benefit | Limitation |

|---|---|

| Fast, cheap transactions | Network outages and failed trades |

| High trading volume | Skewed market data and centralization risk |

Always use bots in a fair way. Think about what is good and bad before using them. Being honest helps people trust you and keeps your project strong for a long time.

FAQ

What is the main purpose of a Solana volume bot?

A Solana volume bot helps your token look more active. It does this by making many small trades. This can help your token get noticed on trading platforms.

Can you use a Solana volume bot without coding skills?

Yes, you can use most Solana volume bots without knowing how to code. Many bots have easy interfaces and Telegram controls. You just connect your wallet and set your preferences.

Are Solana volume bots legal to use?

You should check the rules in your country before using a volume bot. Some places see fake trading as market manipulation. Platforms may also ban tokens that use bots.

How do you spot if a token uses a volume bot?

Look for these signs:

- Sudden spikes in trading volume

- Many small trades in a short time

- Unusual trading patterns

These clues can help you spot bot activity.