Does StockHero Place Bets Automatically?

Ever wondered if you can step away from your screen and let technology handle your trades? The question “does StockHero place bets automatically” is at the heart of modern investing, especially as automated trading bots become more common in both stock and crypto markets. But what does it really mean for a platform to “place bets automatically”—and how does StockHero fit into this picture?

First, let’s clear up the terminology. In trading, “placing bets” is simply another way of saying “executing trades.” Instead of rolling dice or spinning a wheel, you’re instructing a system to buy or sell assets based on specific rules or strategies. With StockHero, this process is entirely automated: once you set up your strategy, the platform monitors the market and places trades on your behalf, no manual clicks required.

Imagine this scenario: You’ve spent hours developing a trading plan, but when it’s time to execute, emotions—fear, greed, hesitation—can get in the way. Automated trading bots like StockHero are designed to solve exactly this problem. By sticking to predefined rules, they remove human emotion from the equation, allowing for consistent, data-driven decisions 24/7. This means you don’t have to worry about missing opportunities while you’re at work, asleep, or simply taking a break.

- Efficiency: Automated bots can scan and act on market signals much faster than any human could.

- Discipline: Bots follow your strategy to the letter, never second-guessing or straying from the plan.

- Accessibility: Platforms like StockHero let both beginners and experienced traders access sophisticated automation without needing to code or manage complex setups.

The rise of automated trading bots has transformed how people approach investing. No longer reserved for hedge funds or Wall Street pros, automation is now available to anyone with an internet connection and a trading idea. Whether you’re looking for a hands-off experience or want to test advanced strategies, StockHero’s automation tools can help you participate in the market with greater confidence and less stress.

In this guide, you’ll discover exactly how StockHero’s automation works, step by step. We’ll break down the mechanics behind automatic trade execution, explore customization options, and highlight the essential role of risk management. Whether you’re just starting out or looking to refine your trading edge, you’ll find practical insights to help you make the most of automated trading bots.

What is StockHero’s Core Functionality?

Have you ever wished you could automate your trading ideas without learning to code or handing your money over to a third party? That’s exactly where StockHero steps in as a modern automated stock trading platform designed for both beginners and seasoned traders.

Cloud-Based, No-Code Automation for Stocks and Crypto

At its core, StockHero is a cloud-based, Software-as-a-Service (SaaS) platform. Instead of requiring complex downloads or technical know-how, you access StockHero entirely through your web browser or mobile device. This means you can monitor, tweak, or launch your trading bots from anywhere—no special hardware or installations required (StockHero Documentation).

But what really sets StockHero apart is its no-code approach. Imagine building a StockHero trading bot using a simple drag-and-drop interface: you select your preferred trading indicators, set entry and exit rules, and define how much you want to allocate. There’s no programming or scripting involved. In just a few steps, anyone—from a curious beginner to a professional trader—can automate their strategy and let the system handle the rest.

Secure API Integration: You Stay in Control of Your Funds

One of the most common concerns with automated trading platforms is, “Where does my money go?” With StockHero, you never deposit funds directly onto the platform. Instead, the platform connects to your existing brokerage account through a secure API (Application Programming Interface). Think of the API as a safe bridge: StockHero sends trade instructions to your broker, but never directly holds or moves your money itself.

- Direct connection: StockHero links to brokers like TradeStation and others via API.

- Fund safety: Your assets remain in your brokerage account at all times.

- Full transparency: You can see every trade, allocation, and balance directly through your broker.

Who Is StockHero For?

Wondering if this platform fits your needs? StockHero’s design caters to a broad spectrum of users:

- Beginners: Use the Bots Marketplace to rent pre-built strategies and start trading with just a few clicks.

- DIY Traders: Experiment with the drag-and-drop bot builder to automate your own trading ideas—no coding required.

- Professionals: Deploy and test complex, multi-indicator strategies, monitor performance, and fine-tune risk parameters for more advanced needs.

Whether you want to automate a simple moving average crossover or a multi-layered technical strategy, StockHero provides the tools to do so in a user-friendly, accessible way.

Next, let’s dive deeper into how StockHero actually executes trades automatically, and what makes its rule-based automation so effective for a wide range of trading styles.

The Mechanics of Automatic Trade Execution

When you hear about “automatic trade execution,” you might picture a bot making split-second decisions while you sleep. Sounds complex? In reality, StockHero’s automation is designed to be both powerful and approachable—whether you’re a cautious beginner or a seasoned trader.

Rule-Based Trading: Your Strategy, Automated

At the heart of StockHero are rule-based trading bots. These bots don’t act on hunches or market rumors—they follow your explicit instructions. Here’s how it works:

- Define Your Rules: You set entry and exit conditions. For example, “Buy when the 50-day moving average crosses above the 200-day moving average,” or “Sell if the price drops 5% from purchase.” No coding is required—just select your parameters using the platform’s intuitive interface.

- Continuous Market Monitoring: Once your bot is live, it watches the market 24/7 for your chosen conditions. There’s no downtime—your bot never sleeps, never hesitates, and never lets emotions cloud its judgment (StockHero Blog).

- Signal Generation: When the market matches your entry criteria, the bot generates a “signal”—an instruction to act.

- Trade Execution: The bot sends trade orders directly to your connected brokerage account via secure API. No manual clicks or confirmations are needed; the process is fully automated.

- Deal Management: Each trade is bundled into a “Deal,” which tracks the lifecycle of that position. The bot handles not just buying and selling, but also risk management steps like stop-loss and take-profit orders, all according to your preset rules.

- Real-Time Adjustment: If your strategy includes dynamic rules—like trailing stop-losses or multiple profit targets—the bot adjusts in real time as the market evolves.

From Signal to Execution: A Walkthrough

Imagine you’ve set up a bot to buy shares of a stock whenever its RSI (Relative Strength Index) falls below 30—a classic oversold signal. Here’s what happens next:

- The bot continuously monitors the RSI for your chosen stock.

- When RSI dips below 30, the bot instantly generates an entry signal.

- It places a buy order with your broker, starting a new “Deal.”

- If the price later rises and hits your take-profit target, or drops to your stop-loss, the bot automatically closes the position—no intervention needed.

This entire cycle happens without you having to watch the market or react in real time. The bot ensures your strategy is executed with discipline and speed, regardless of market volatility.

Why This Matters: Removing Emotion and Manual Errors

One of the biggest advantages of automatic trade execution is the elimination of emotional trading. Bots stick to the rules—no panic selling in a downturn, no FOMO during a rally. This objectivity often leads to more consistent results over time.

Plus, automation means you won’t miss out on opportunities just because you’re away from your desk or asleep. The bot is always on, always alert, and always ready to act on your behalf.

Professional-Grade Logic: StockHero and TradeWiz

It’s worth noting that this rule-based, signal-to-execution logic isn’t unique to StockHero. Advanced platforms like TradeWiz use identical principles—automating trades based on user-defined strategies, with added features like lightning-fast execution and AI-powered risk management. The core idea remains the same: once your rules are set, the bot operates within those boundaries, removing the need for manual intervention while ensuring your strategy is always in play.

With the mechanics of automation clear, you might be wondering: How much control do you have over your bot’s strategy? Next, we’ll explore how StockHero lets you customize your trading automation—whether you want to build a bot from scratch or leverage proven strategies from the marketplace.

Customizing Your Automated Bot

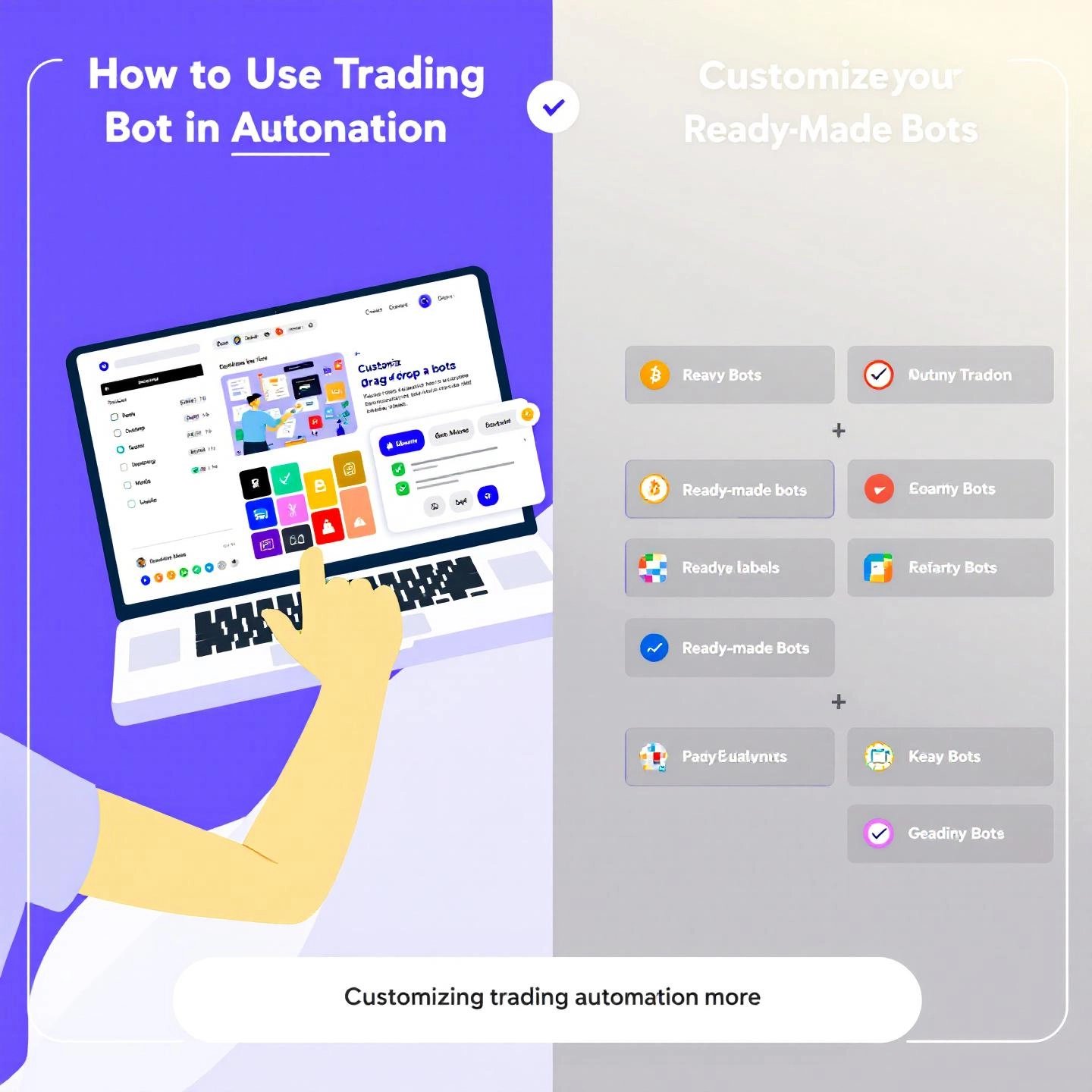

When you first consider automating your trades, you might wonder: Should you design your own strategy or start with a proven one? StockHero offers two main paths: the intuitive StockHero bot builder for custom creations, and the StockHero bots marketplace for ready-to-go strategies. Each approach caters to different skill levels, risk appetites, and time commitments.

Option 1: Building Your Own Bot with the Drag-and-Drop Bot Builder

Imagine you have a trading idea—say, buying when a stock’s RSI dips below 30 and selling when it climbs above 70. With StockHero’s drag-and-drop bot builder, you can turn this vision into an automated reality, all without writing a single line of code. The visual interface guides you step by step:

- Choose your indicators: Select from a wide range of technical tools like MACD, Bollinger Bands, or simple price triggers.

- Set entry and exit rules: Define exactly when your bot should buy, sell, or hold based on your strategy.

- Adjust risk parameters: Allocate funds, set stop-losses, or add trailing stops for dynamic protection.

- Test before you launch: Use StockHero’s built-in backtesting to see how your bot would have performed in past markets (StockHero FAQ).

This hands-on approach is perfect for traders who want full control and the flexibility to tweak or refine their strategies as market conditions change. You’ll notice that the more you experiment, the better you understand your own trading style and risk tolerance.

Option 2: Renting a Bot from the Bots Marketplace

Not sure where to start, or want to skip the trial and error? The StockHero bots marketplace features a curated selection of pre-configured bots built by experienced traders. These bots are ready to deploy—no setup headaches, no guesswork. Here’s how it works:

- Browse available bots: Filter by strategy type, asset class, or performance metrics.

- Review performance: Each bot displays key stats like win rate, average return, and number of trades.

- Rent and customize: Once you select a bot, you can adjust basic settings (such as which stocks to trade or capital allocation) to fit your needs.

- Start trading instantly: After setup, your rented bot begins executing trades on your behalf, following its proven logic.

This approach is ideal if you’re new to automated trading, short on time, or want to leverage the expertise of seasoned strategists. It’s also a good way to diversify—rent several bots with different strategies to spread your risk.

Comparing Custom Bot Building vs. Marketplace Rentals

| Feature | Custom Bot Builder | Bots Marketplace |

|---|---|---|

| Level of Control | Full—design every rule and parameter | Moderate—adjust basic settings only |

| Skill Required | Basic trading knowledge helps; no coding needed | Beginner-friendly; no experience required |

| Setup Time | Longer—depends on strategy complexity | Minimal—ready in minutes |

| Strategy Source | Your own ideas and preferences | Proven strategies from experienced traders |

| Customization | Extensive—fine-tune every aspect | Limited—mainly asset selection and allocation |

Which Approach Is Right for You?

If you enjoy experimenting, want granular control, or have a specific strategy in mind, the StockHero bot builder is your toolkit. But if you prefer a plug-and-play solution or want to learn from the best, the StockHero bots marketplace offers a shortcut to automation with less risk of beginner mistakes.

Many users find value in combining both methods—start with a marketplace bot to learn the ropes, then graduate to building custom bots as your confidence grows.

Whichever route you choose, StockHero’s platform ensures you have the flexibility to automate trading in a way that matches your goals and experience. Next, let’s explore why risk management remains essential—even when your trades are fully automated.

The Essential Role of Risk Management in Automated Trading

When your trades are running on autopilot, it’s easy to believe that the hard work is done. But here’s a question every trader should ask: If StockHero is placing trades automatically, who’s making sure you don’t lose more than you’re willing to risk? This is where automated trading risk management steps in as your safety net.

Why Risk Management Still Matters—Even with Bots

Imagine letting a trading bot run wild without any guardrails. Sounds risky, right? Automation is powerful, but it’s only as safe as the rules you set. While StockHero’s bots can execute trades with speed and discipline, they rely on you to define the boundaries. Without risk controls, a single market swing could wipe out your gains—or worse, your entire account.

StockHero integrates a suite of built-in risk management tools to help you stay protected, even when you’re not watching the screen. Let’s break down the essentials:

- Fund Allocation: Decide exactly how much capital each bot can access. By limiting exposure, you prevent a single strategy from risking more than you can afford to lose. For example, you might allocate only 10% of your portfolio to a high-volatility bot, keeping the rest in safer strategies or cash reserves.

- Stop-Loss Orders: These are your automated exit plans. If a trade moves against you, a stop-loss order will close the position at a pre-set loss threshold, capping your downside. This is especially crucial in fast-moving or volatile markets, where prices can swing dramatically in minutes.

- Take-Profit Orders: On the flip side, take-profit orders lock in gains when your target price is reached. You set the rules—when the bot hits your profit goal, it exits the trade, preventing greed from erasing your winnings.

- Trailing Stops: Want to let profits run while still protecting gains? Trailing stop-losses adjust automatically as the market moves in your favor, securing profits if the trend reverses.

- Circuit Breakers: Think of these as emergency brakes. If the market experiences extreme volatility or your bot hits a series of losses, a circuit breaker can pause trading or shut down the bot entirely, giving you time to reassess before risking more capital.

Real-World Example: StockHero’s Sigma Series and Market Neutral Strategies

During recent market turmoil, StockHero’s Sigma Series bots showcased the importance of robust risk management. By executing stop-loss orders before further declines, these bots minimized losses and preserved capital, even as the S&P 500 dropped sharply. The Market Neutral strategy, meanwhile, maintained balanced exposure and generated profits from short-term price swings—demonstrating how disciplined risk controls can keep you in the game when others are sidelined (StockHero Blog).

Beyond the Basics: Advanced Controls with TradeWiz

If you’re looking for even more sophisticated ways to manage risk, platforms like TradeWiz take it a step further. For example, TradeWiz offers cross-exchange risk synchronization—meaning you can halt bots on multiple platforms (such as Binance and Bybit) simultaneously in response to a major event. This kind of unified control is especially valuable for traders running diversified strategies across several markets, ensuring that your entire portfolio can respond instantly to changing conditions.

Automation Executes—You Set the Rules

Here’s the bottom line: Automated trading bots like StockHero are powerful tools for executing your strategy 24/7, but they don’t replace the need for strong risk management. You’re still in charge of setting the rules—bots simply enforce them with discipline and speed. By leveraging built-in tools like fund allocation, stop-loss in trading bots, and circuit breakers, you can automate confidently, knowing your risk framework is always in place.

Ready to see how your strategies perform under real-world conditions? Next, we’ll explore how to validate your automated trading setup through backtesting and paper trading—crucial steps to build confidence before risking real capital.

Validating Your Strategy

Ever felt the rush of launching a new trading bot, only to wonder if your strategy is really ready for live markets? Before you risk real money, it pays to put your ideas to the test. That’s where backtesting trading strategies and paper trading bots come into play—two essential tools StockHero offers to help you trade with confidence.

Why Test Before You Trade?

Imagine building a bridge without checking if it can hold weight. Trading is no different; you need proof your strategy works before letting it handle your capital. Testing helps you answer key questions: Does my bot behave as expected in different market conditions? Are my risk controls working? Am I likely to face unexpected losses?

Backtesting: Learn from the Past

Backtesting is like rewinding the market and asking, “How would my strategy have performed if I’d used it before?” StockHero lets you run your bot through historical data, simulating every trade signal, entry, and exit based on your rules. You’ll see how your system would have fared during bull runs, market crashes, or sideways trends. This process gives you a reality check—highlighting strengths, weaknesses, and areas to improve.

- Multiple Time Frames: StockHero supports backtesting over various periods—1 day, 1 week, 1 month, up to 1 year. Testing across different spans helps you spot strategies that only work in specific conditions, or those that stand the test of time.

- Custom Dates: On certain plans, you can set custom date ranges for even more targeted analysis.

- Performance Metrics: Review the number of trades, win/loss ratio, drawdowns, and profit/loss to assess reliability.

But remember: strong backtest results don’t guarantee future profits. Markets evolve, and past performance is just one piece of the puzzle.

Paper Trading: Practice in Real Time, Risk-Free

Once you’re happy with your backtest, it’s time for a trial run—without risking a dime. StockHero’s paper trading bots let you deploy your strategy on a simulated exchange using virtual funds. The platform mirrors real market movements, so you can see how your bot reacts to live prices, fills, and volatility (StockHero Paper Trading Guide).

- Start with $10,000 Virtual Balance: Every new paper trading account receives a simulated USD balance, which you can adjust for your needs.

- Test Execution: Observe how your bot handles real-time signals, order fills, and slippage—just as it would with actual capital.

- Refine and Iterate: Spot issues, adjust parameters, and rerun tests until you’re confident in your setup.

This hands-on simulation bridges the gap between theory and real-world trading, helping you iron out any kinks before going live.

Best Practices for Strategy Validation

- Combine Backtesting and Paper Trading: Use both to get a complete picture—historical performance plus live execution.

- Test Across Market Conditions: Make sure your strategy isn’t just optimized for bull markets or a single time frame.

- Document Findings: Keep notes on what works, what fails, and why—continuous improvement is key.

“A good backtest result does NOT guarantee good future performance.”

By leveraging StockHero’s robust testing features, you can validate your strategy with data, not just hope. This approach builds confidence and discipline—so when you finally go live, you’re not just betting on luck, but on a system that’s been put through its paces.

With your strategy thoroughly tested, the next step is connecting StockHero to your brokerage for seamless, automated execution in the real market.

How StockHero Integrates with Brokerages for Automated Trading

Ever wondered how your automated trading bot actually places real trades in your brokerage account? It might sound technical, but StockHero makes API trading integration simple and secure—so you can focus on strategy, not on the tech details. Let’s walk through how StockHero connects to the market, which brokerages are supported, and what your options are if your preferred broker isn’t on the list.

API Trading Integration: The Secure Bridge to Your Broker

When you set up a bot on StockHero, you don’t need to move your funds or share your brokerage login details. Instead, you connect your brokerage account to StockHero using what’s called an API key. Think of the API as a secure bridge: it lets StockHero send trade instructions to your broker, but never gives the platform access to withdraw or transfer your money directly. Your assets always remain in your brokerage account, and you retain full control.

- Easy setup: Most supported brokers offer a straightforward API key generation process. You paste this key into StockHero, and you’re ready to automate trades.

- Read-only or trading permissions: You can choose what level of access your API key provides, giving you peace of mind and flexibility.

- No sensitive passwords shared: Your login credentials stay private—StockHero never asks for them.

StockHero Supported Brokerages

StockHero supports a variety of popular brokerages for both stocks and crypto. This growing list ensures that traders from different regions and with different preferences can find a compatible partner. As of now, the following brokerages are supported:

- TradeStation

- Alpaca (also supports crypto trading)

- Stake Australia

- Tradier

- Tiger Brokers

- Webull

- Wealthsimple

- E*Trade

- Robinhood Crypto (cryptocurrencies only)

Some brokers may be marked as “beta,” which means they’re newly added and may be undergoing additional fine-tuning. If you don’t see your favorite broker on the list, StockHero is actively expanding its integrations and welcomes user suggestions for future additions.

What If Your Broker Isn’t Supported?

Don’t worry if your broker isn’t currently integrated. StockHero offers a flexible solution: you can use the platform as a signal provider. In this mode, your bot will monitor the markets and generate trade signals based on your configured strategy. Instead of executing trades automatically, StockHero will send you alerts via email, in-app notifications, or SMS (for Professional users). You can then choose to place trades manually with your preferred broker, giving you the benefits of automation without full integration (StockHero FAQ).

- Receive real-time trade signals for any market StockHero supports.

- Retain full manual control over trade execution and broker choice.

- Test strategies risk-free before committing to a new brokerage or automated workflow.

Seamless Market Access, Your Way

Whether you’re connecting directly to a supported broker or using StockHero as a signal provider, you’ll notice one thing: the process is designed to be secure, transparent, and flexible. You never have to compromise on fund safety or privacy, and you can adapt your automation setup as your trading needs evolve.

With your brokerage connected and automation in place, you’re ready to let your strategies run in the real market—knowing that every trade is executed just as you intended. In the final section, we’ll recap the key takeaways and point you toward advanced solutions for traders seeking even more automation power and flexibility.

Conclusion

When you first asked, “Does StockHero place bets automatically?” you were really searching for a platform that could handle your trades without constant oversight. Now, having explored StockHero’s mechanics, customization, and risk management, you can see the answer is a clear yes—StockHero does indeed execute trades automatically, following the strategies and rules you set up. But as you’ve learned, this automation is not a magic profit button. Instead, it’s a disciplined, data-driven tool designed to help you stick to your trading plan, minimize emotional errors, and participate in markets around the clock.

What Makes Automated Trading So Valuable?

- Discipline and Consistency: Bots never tire, never panic, and never stray from your predetermined rules. This removes much of the emotion and inconsistency that can derail manual traders.

- Efficiency and Speed: Automated trading platforms scan markets, generate signals, and execute trades faster than any human could—ensuring you don’t miss opportunities while you’re away from your screen.

- Customization and Control: Even though the process is automated, you retain full control over your strategy setup, risk parameters, and testing. You decide how aggressive or conservative your automation should be.

- Risk Management: With features like fund allocation, stop-loss, and circuit breakers, you set the boundaries—automation simply enforces them, 24/7.

However, it’s important to remember: no automated trading system can guarantee profits. Markets are unpredictable, and even the best bots require careful monitoring, regular strategy reviews, and ongoing learning. Automation is a powerful ally, but it doesn’t replace sound judgment or the need for a robust risk management framework.

Looking for the Best Trading Bot Alternatives?

Maybe after exploring StockHero, you’re wondering if there are even more advanced, fully automated trading solutions that can push your results further, or make things even easier. For traders who want to go beyond rule-based bots and embrace features like copy trading, lightning-fast execution, and AI-powered risk controls, platforms like TradeWiz stand out as compelling alternatives.

- Copy Trading: TradeWiz allows you to automatically mirror the trades of top-performing wallets—meaning you benefit from proven strategies without having to build your own from scratch (TradeWiz Bot Review).

- Superior Speed: With execution times under four seconds, TradeWiz helps secure better entry and exit prices, a key advantage in fast-moving markets.

- AI Risk Management: Advanced AI algorithms monitor market conditions and adjust risk parameters in real time, offering an extra layer of protection for your capital.

- User-Friendly Experience: Operate everything from a simple Telegram interface, lowering the technical barriers often found in algorithmic trading.

Choosing the best trading bot alternative comes down to your goals, experience, and appetite for automation. If you value hands-on strategy design and granular control, StockHero’s no-code platform is a solid fit. If you prefer a plug-and-play, copy trading model with advanced AI and seamless usability, TradeWiz may be the better choice.

“Treat every algorithm—including StockHero’s—like an intern: brilliant potential, but someone (you) must supervise.”

In the end, the world of automated trading is rich with opportunity. Whether you stick with StockHero, explore TradeWiz, or combine both, the most important step is to keep learning, stay disciplined, and pick the automation solution that fits your unique trading journey. Ready to take the next step? Explore these platforms, test your strategies, and find the automation style that empowers your investing goals.

Frequently Asked Questions About StockHero Automated Trading

1. Does StockHero execute trades automatically for users?

Yes, StockHero is designed to automatically execute trades based on user-defined strategies. Once you set your entry and exit rules, StockHero’s bots monitor the market and place trades on your behalf through secure API connections with supported brokerages. This hands-free approach helps traders avoid emotional decisions and react to market changes 24/7.

2. How does StockHero connect to my brokerage account?

StockHero connects to your brokerage using secure API keys, which allow the platform to send trade instructions without accessing your login credentials or directly holding your funds. Your assets remain safely in your brokerage account, and you control the permissions granted to StockHero for executing trades.

3. Can I customize my trading bot on StockHero without coding skills?

Absolutely. StockHero provides a no-code, drag-and-drop bot builder that lets users design and automate trading strategies visually. You can select indicators, set risk parameters, and test your bot before going live, making it accessible for both beginners and experienced traders.

4. What risk management features are available in StockHero?

StockHero offers several built-in risk management tools, including fund allocation limits, stop-loss and take-profit orders, trailing stops, and circuit breakers. These features help you define your maximum risk and protect your capital, ensuring your automated trades stay within your chosen boundaries.

5. Are there advanced alternatives to StockHero for automated trading?

Yes, solutions like TradeWiz provide advanced automation features such as AI-powered risk management, ultra-fast execution, and copy trading. TradeWiz allows you to mirror top traders’ strategies automatically, offering a user-friendly experience and robust risk controls for those seeking more comprehensive automation.