Introduction

When it comes to trading, one of the most important factors to consider is the number of available crypto trading days. Unlike traditional stock markets, which are limited to weekdays and closed on holidays, cryptocurrency markets like Solana trading remain open 24/7, providing endless opportunities for traders. Understanding how many crypto trading days are in a year can help you better plan your trading strategy, especially if you’re using tools like AI trading bots or platforms such as Tradewiz to automate your trades. In this guide, we’ll explore the unique nature of crypto trading days, why they matter, and how you can maximize your trading potential throughout the year.

In this post, we’ll dive into how many trading days there are in a year, why this number matters for your trading strategy, and how platforms like Tradewiz, a leading AI trading bot, can enhance your trading efficiency.

https://www.swingtradesystems.com/trading-days-calendars.html#google_vignette

What Are Crypto Trading Days?

1. What Is a Trading Day?

A trading day refers to any day when a financial market is open and you can execute buy and sell orders for assets. For example, Solana trading, or buying and selling cryptocurrency, can take place on any day of the year, but traditional stock markets like the NYSE or NASDAQ have specific opening hours.

- Stock Markets: Typically, stock exchanges are open Monday to Friday, excluding public holidays. For example, the US Stock Market is open from 9:30 AM to 4:00 PM Eastern Time, but is closed on weekends and on specific holidays.

- Cryptocurrency Markets: Unlike stock markets, cryptocurrency markets such as Solana trading are open 24/7. This means you can trade at any time, regardless of weekends or holidays.

Sources:

2. How Many Trading Days in a Year?

Now that you know what a trading day is, let’s discuss how many trading days there are in a year for both traditional and crypto markets.

Stock Markets

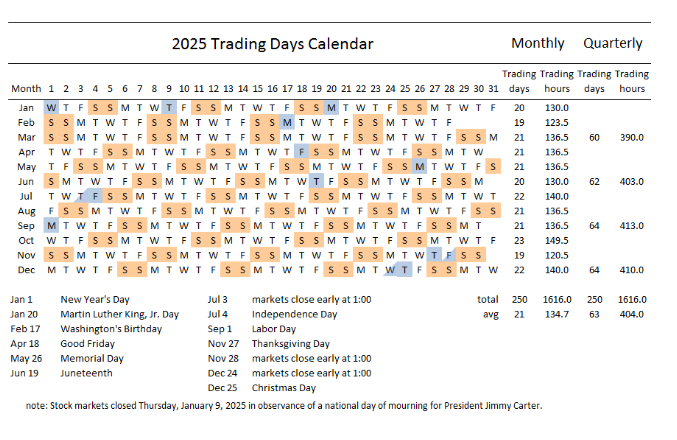

In the case of traditional stock markets, trading days are generally limited to weekdays, and public holidays are typically observed. For example, the US stock market usually has around 252 trading days per year.

- US Stock Market: 252 trading days per year, accounting for weekends and public holidays like Thanksgiving, Independence Day, and New Year’s Day.

- Global Stock Markets: While the US has 252 trading days, other countries may have slightly more or fewer, depending on the specific market holidays in those regions.

Cryptocurrency Markets

On the other hand, cryptocurrency markets like Solana trading operate 24/7, meaning that traders can execute trades any day of the year, totaling 365 trading days.

The ability to trade at any time means that AI trading bots like Tradewiz are highly effective in cryptocurrency markets because they can continuously monitor and execute trades around the clock, without you having to worry about time zones or market hours.

Sources:

Why Crypto Trading Days Matter for Your Strategy?

1. Impact on Strategy

Knowing how many trading days are available in a year is fundamental to forming your trading strategy. For example:

- Limited Trading Days: If you’re trading on a stock market with only 252 trading days, your strategy might focus on long-term investments or short-term trades that capitalize on specific events, such as earnings reports or market news. The fewer trading days available means you’ll need to carefully plan your trades to maximize the potential within those days.

- Unlimited Trading Days in Crypto: In cryptocurrency markets, the ability to trade every day of the year opens up new opportunities. For traders looking to make profits from daily volatility, this can be a huge advantage. However, it also means that the market can be unpredictable, and you’ll need to use tools like AI trading bots to help manage risk and automate your trading decisions.

2. Impact on Risk Management

The number of trading days also impacts risk management. With limited trading days, stock traders have fewer opportunities to take advantage of price movements, so their risk management might be more focused on minimizing losses. In contrast, Solana trading and other cryptocurrencies require constant monitoring, and AI trading bots can help mitigate risk by automatically adjusting strategies based on real-time market conditions.

- Crypto Volatility: Cryptocurrency markets are known for their high volatility, so traders need a strategy that can handle price swings 24/7. Using AI trading bots like Tradewiz to automate trading based on pre-set conditions can help protect you from major losses by executing trades during periods of high volatility.

How to Make the Most of Crypto Trading Days

1. Using AI Trading Bots for 24/7 Crypto Trading Days

In a world where markets operate around the clock, technology plays a crucial role in ensuring you don’t miss any trading opportunities. With Solana trading, you can access a global, decentralized market at any time, but keeping track of price movements and managing trades manually can be time-consuming and difficult. Here, AI trading bots like Tradewiz come into play.

- AI Trading Bots: These bots use artificial intelligence to make real-time decisions based on market data, without the need for constant human intervention. Tradewiz is one such platform that allows you to automate your trading, ensuring that your trading strategies are executed even when you’re not monitoring the market.

- Continuous Trading: With AI trading bots, you can trade without worrying about market hours, making it ideal for cryptocurrency traders who want to take advantage of 24/7 market dynamics. Whether it’s setting stop losses, executing trades at specific times, or even mimicking successful traders, Tradewiz offers a wide range of automation options to help improve your trading outcomes.

Sources:

2. Leveraging Tradewiz to Maximize Crypto Trading Days

Tradewiz offers a suite of tools designed to improve your trading experience. By using its AI trading bots, you can access multiple features that work together to reduce risk and increase efficiency. Here’s a closer look at how Tradewiz can benefit your trading:

- Anti-MEV Protection: Tradewiz includes Anti-MEV features that protect your transactions from MEV attacks, ensuring that your trades are secure and executed swiftly.

- All-in-One Features: With Tradewiz, you get an all-in-one platform to minimize risks and manage investments. Whether you are new to Solana trading or an experienced crypto trader, Tradewiz provides you with all the tools you need for effective risk management.

- Auto-Sell Feature: If you are following successful traders or using a copy trading strategy, Tradewiz offers an Auto-Sell feature, which automatically executes a sale when a preset limit price is reached after copying a trade.

For more details on how to use Tradewiz, check out the complete guide here.

Sources:

Conclusion: Optimizing Your Crypto Trading Days with Tradewiz

Understanding the number of trading days in a year is essential to planning your trading strategy, whether you’re involved in traditional stock markets or more dynamic markets like cryptocurrency. While stock markets have a fixed number of trading days, the Solana blockchain and other cryptocurrency markets remain open year-round, offering endless trading opportunities. However, to maximize those opportunities, you need the right tools, and that’s where AI trading bots like Tradewiz come in.

By automating your trades with Tradewiz, you can take advantage of market fluctuations 24/7, manage risk effectively, and execute trades automatically based on your preferred strategies. For new traders, Tradewiz can serve as an invaluable tool to help you succeed in the fast-paced world of Solana trading.

FAQs ABOUT TRADING DAYS

1. How many trading days are in a year for cryptocurrencies?

In cryptocurrency markets, there are 365 trading days per year because crypto markets are open 24/7.

2. What is an AI trading bot?

An AI trading bot uses machine learning algorithms to make automated trading decisions. It analyzes market data and executes trades based on predefined parameters. Platforms like Tradewiz offer advanced bots that can optimize your trading strategies and protect you from volatility.

3. How can Tradewiz help me automate my trading?

Tradewiz allows you to automate your trades through its AI trading bots. Features like Anti-MEV, All-in-One functionality, and Auto-Sell can help you trade efficiently and safely, without needing to manually execute each trade.