Introduction: Why Solana Sniper Bots Matter in 2025

Solana sniper bots are changing the game in crypto trading. These powerful bots allow you to detect and execute trades on new tokens milliseconds after launch—long before most manual traders can react. In the fast-paced Solana ecosystem, where slot times average just 400 milliseconds, using a sniper bot can mean the difference between catching a 10x pump or missing the opportunity entirely.

If you’re looking to build or use a sniper bot on Solana in 2025, this guide will walk you through everything you need to know—from infrastructure and strategy to tools like TradeWiz, a top-tier Solana copy trading bot.

What Is a Solana Sniper Bot and How Does It Work?

Real-Time Liquidity Monitoring and Token Launch Detection

A sniper bot is an automated trading script that monitors Solana DEXs like Raydium, Orca, Jupiter, and Meteora for new token liquidity pools, then instantly submits buy transactions before prices surge.

It uses:

- WebSocket subscriptions to get real-time account changes

- Blockchain parsers to detect token mints or liquidity adds

- Pre-signed transactions for faster deployment

Bots can buy tokens within 0.4 to 0.8 seconds after launch—before retail users even see the coin listed on aggregators like Birdeye or DexScreener.

Why Milliseconds Matter: Slot Times, RPC Delays & Price Curves

Solana finalizes blocks every ~400ms. A 1-second delay = 2 slot misses = a price that might be 10x higher.

Using public RPCs? You’re already losing. Bots on private RPCs, close to validators, win the race. For example:

| Network | Avg. Block Time | Trade Window |

|---|---|---|

| Solana | ~0.4 sec | 500ms ideal |

| Arbitrum | ~3 mins | Sniping not viable |

| Ethereum | ~12s | Too slow |

(Source: Solana Docs, 2025)

Infrastructure for High-Speed Trading Bots on Solana

RPC Fast, Jito ShredStream, and Dedicated Validators

You’ll need:

- Private RPCs like RPC Fast or QuickNode

- Jito ShredStream, which streams unconfirmed transactions directly from Solana leaders

- Geographically close RPC endpoints to reduce latency

Pro Tip: Slot drift of just 2 slots = missing the token entirely.

Setting Up Your Solana Trading Bot with Low-Latency RPC

Your setup should include:

- WebSocket listener

- Real-time parser (Raydium, Orca pool detection)

- Pre-signed transaction pool

- Parallel wallet execution

from solana.transaction import Transaction

from solana.rpc.api import Client

client = Client("https://your-private-rpc")

tx = Transaction()

tx.add(your_instruction)

signed_tx = tx.sign(your_private_key)

client.send_transaction(signed_tx)

You’re now sending your snipes milliseconds before the crowd.

Solana Sniping Strategies: When to Buy, What to Watch

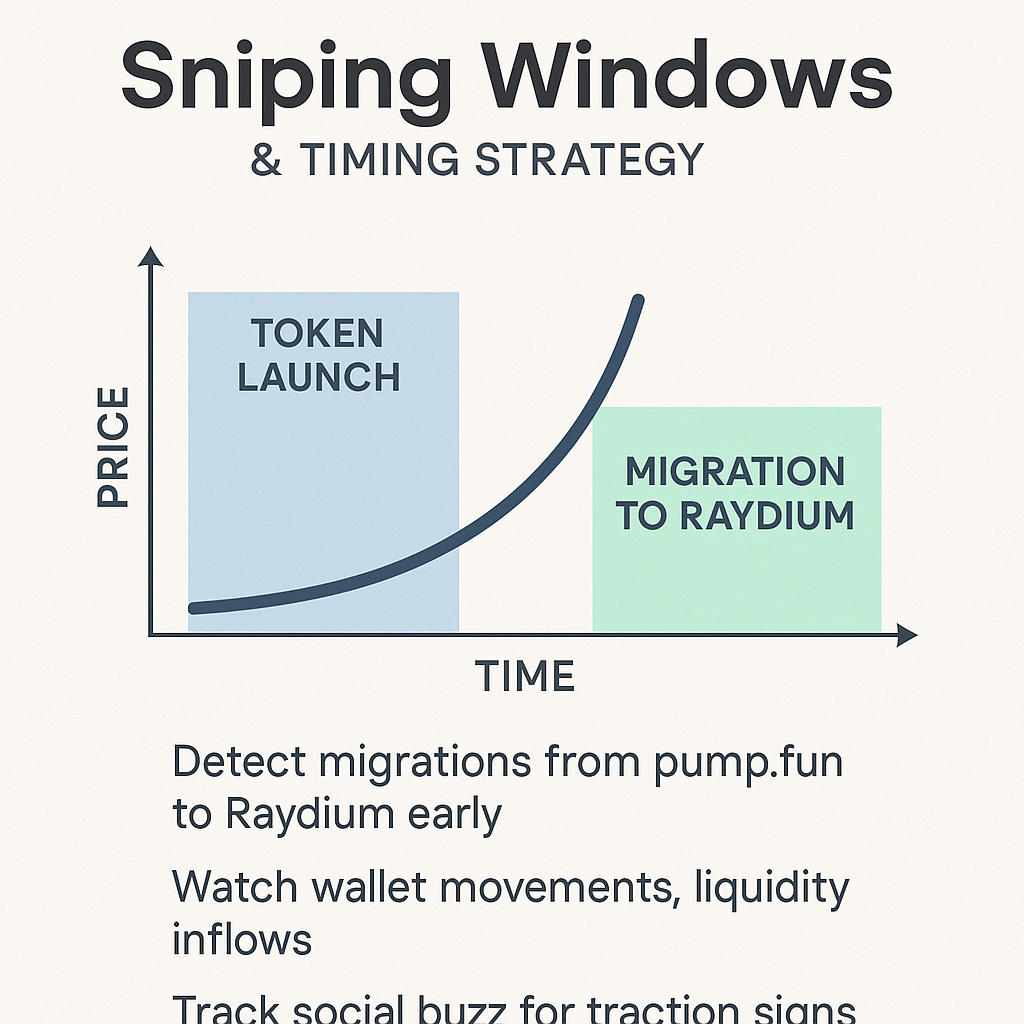

Best Timing Windows: Token Launches and pump.fun Migrations

Tokens on pump.fun often migrate to Raydium after they hit critical liquidity or community milestones. These migrations happen within seconds and bots that detect them early win big.

How to Monitor:

- Check for migration account

39azUYFW...UJjg - Watch

create_poolevents on Raydium - Use GitHub script

listen_to_raydium_migration.py

Tracking Telegram/Discord/X for Early Signals

Traders also use social signals:

- Monitor 300+ top Twitter/X accounts

- Join premium Telegram groups

- Use bots to detect keywords like “loading”, “entry”, “live soon”

💡 87% of meme coin pumps begin within 30 minutes of social promotion. (Source: Step Finance Research, 2024)

Risk Management in Solana Sniper Trading

Detecting Rugpulls, Honeypots, and Blacklisted Tokens

To avoid buying into scams:

- Check burned LP tokens

- Verify freeze authority is revoked

- Look for honeypot signs: test sells blocked, LP moved, contract not verified

Tools: DexScreener Rug Checker, SolanaFM

Gas Wars, Network Congestion, and How to Survive Them

During launches, bots pay higher priority fees to get included in blocks.

You should:

- Dynamically adjust lamports per transaction

- Avoid peak hours (2PM–8PM UTC = high failure rate)

- Have fallback RPCs ready in case one fails

Building or Using a Solana Sniper Bot Platform

Custom-Built Bots vs. Turnkey Platforms: Pros & Cons

| Aspect | Custom Bot | Platform Bot (e.g. TradeWiz) |

|---|---|---|

| Speed | ⚡ Max control | ⚡ Optimized out of the box |

| Risk | ⚠️ Higher setup risks | ✅ Built-in protections |

| Accessibility | 🧠 Dev skill needed | 👶 User-friendly UI |

Introducing TradeWiz: Solana Copy Trading Made Smart

TradeWiz is a Solana-native sniper & copy trading bot designed for users who want automation without the hassle of coding.

Key Features:

- 🔒 Anti-MEV: Protects you from frontrunning and sandwich attacks

- 🧠 All-in-One Portfolio Tools: Track, manage, and execute in one place

- 💰 Auto-Sell: Automatically exit positions at preset prices

Perfect for:

- New users looking to follow elite wallets

- Advanced users who want to automate portfolio rebalancing

Cost, ROI & Performance Tracking for Solana Sniper Bots

Sniping Fees, Priority Gas Costs & Bot Platform Pricing

| Cost Type | Typical Rate |

|---|---|

| Platform Fee | 1% per trade (e.g., Banana Gun) |

| Solana Tx Fee | ~0.000005 SOL |

| Priority Fee | Dynamic per congestion |

| TradeWiz Pricing | Free (base) / Premium plan TBD |

Monitoring Sniper Bot Performance in Real Time

Use:

- Birdeye: Price, volume, and swaps

- DexTools: Real-time LP monitoring

- Latency log tracking: trade timestamp vs confirmation timestamp

Conclusion: The Future of Solana Sniping—Speed, Smarts, Security

Solana sniping in 2025 is not just about who’s fastest. It’s about who’s:

- Best prepared (infrastructure matters)

- Smartest (real-time strategy + social cues)

- Safest (avoiding rugs and honeypots)

Whether you’re writing code or just want a powerful tool to do it for you, bots like TradeWiz are giving everyday users access to advanced strategies once reserved for whales and developers.

Start small, automate wisely, and never stop optimizing.

Ready to copy trade like a pro? Try TradeWiz today.

Frequently Asked Questions (FAQs)

❓ How do Solana sniper bots detect new token launches?

They use real-time WebSocket feeds and RPC endpoints to detect new liquidity pool creation and token mint events across Raydium, Orca, and pump.fun.

❓ What are the biggest risks with sniper bots?

Rugpulls, blacklists, honeypots, and network congestion. Bots can also fail if latency is too high or if the liquidity isn’t truly tradeable.

❓ Can I use a sniper bot without coding?

Yes! TradeWiz lets you copy experienced traders and automate your trades with zero code. It also protects you with built-in Anti-MEV and Auto-Sell features.

Sources:

- Solana Docs: https://docs.solana.com

- Jito Labs: https://jito.network

- RPC Fast: https://rpcfast.com

- DexScreener Analytics: https://dexscreener.com

- Step Finance: https://step.finance

- TradeWiz Gitbook: https://tradewiz.gitbook.io/tradewiz

Great breakdown of how sniper bots are reshaping Solana trading in 2025. The point about latency—executing trades within milliseconds—is especially crucial given how fast token launches move now. I’d be curious to hear how traders are balancing speed with risk management in such a volatile environment.