In 2025, the crypto markets stand at a crossroads: bullish momentum from institutional adoption clashes with lingering volatility and regulatory uncertainty. Many investors wonder, Is this still the best time to invest in crypto? What is the best crypto to invest in 2025?

With headlines touting the next meme coins and financial institutions racing to onboard digital assets, it’s easy to feel overwhelmed.

In this guide, we distill fresh, expert-driven predictions for July and beyond, spotlight the top cryptocurrencies by market cap, and reveal the best cheap crypto to buy now for long-term gains. You’ll also find a practical startup playbook—covering crypto exchanges, crypto wallets, and risk tolerance strategies—to help you invest crypto confidently in 2025.

Is Crypto a Good Investment in 2025?

You might ask if crypto is still a smart choice in 2025. The answer depends on what you want and how much risk you can take. It also depends on what you think about digital money in the future. Let’s look at it together.

Crypto has grown a lot in the last few years. You can see this in these numbers:

| Metric / Indicator | Statistic / Trend | Implication for 2025 Investment Outlook |

| DeFi Growth | TVL increased from $1 billion in 2020 to $83.72 billion in 2024 | Explosive sector growth and more users joining |

| Bitcoin Price Peak | Bitcoin reached an all-time high of over $73,000 in 2024 | Strong market acceptance and price appreciation potential |

| Solana Price Increase | 10,000% price increase in 2021 | Shows potential for huge gains in altcoins |

| Global Crypto Trading Volume | Projected to exceed $108 trillion by end of 2024 | More liquidity and more people trading |

| Institutional Investor Interest | Over 87% of institutional investors plan to invest in digital assets | Big players are joining in |

| Cryptocurrency ETFs | $4.6 billion trading volume on first day of Bitcoin ETF launch in 2024 | Easier access for investors, likely to boost market growth |

| Regulatory Clarity | EU’s MiCA framework introduced in 2024 | More confidence and stability for investors |

The crypto market keeps getting bigger. More people and companies want to buy crypto. This gives you more choices and better tools. You also have more ways to keep your money safe.

If you want to grow your money over time, crypto can help. Bitcoin and Ethereum have both bounced back after hard times. Many experts think these coins will stay strong for years. You might also find new coins that grow fast, like Solana did in 2021. These can give you big rewards if you hold them.

But remember, crypto prices can change very fast. You need to be okay with this risk. If you want to buy crypto, think about how much you can lose. Never put all your money in one coin. Spread your money out and think about the future.

💡 Tip: If you want to buy crypto for a long time, do your homework and watch the news. This helps you make better choices and avoid mistakes.

In short, crypto looks like a good way to grow your money in 2025. You can join a fast market, but you need to be careful. If you keep learning and think about the long-term, you can get a lot from crypto.

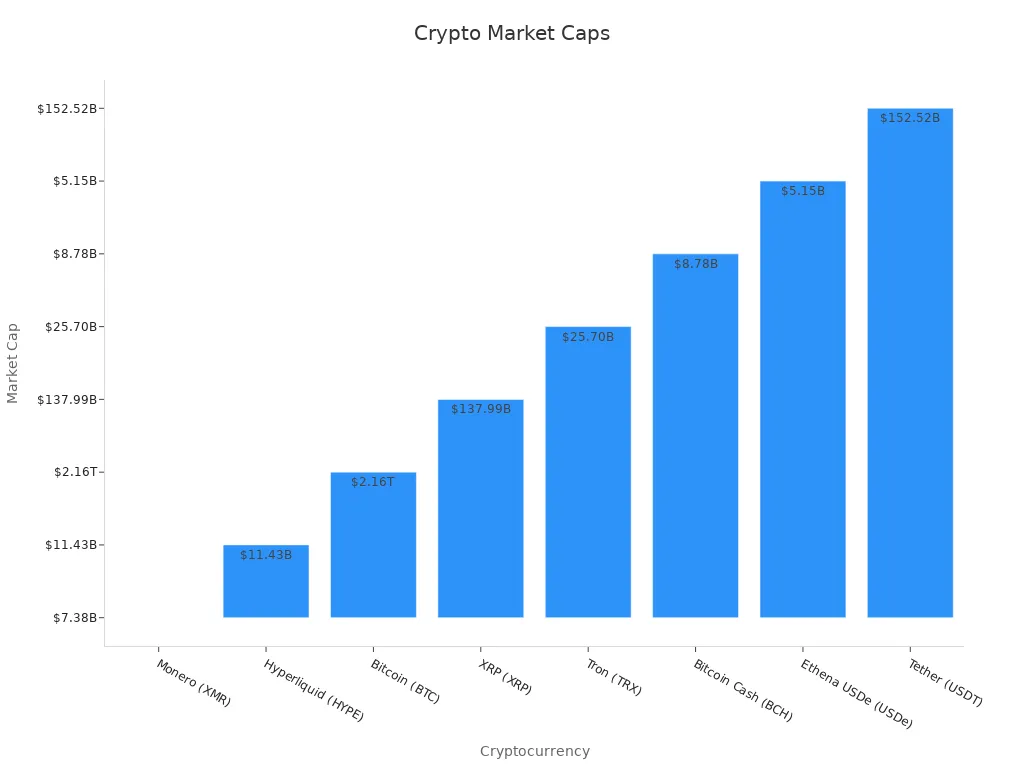

List of Top 20 Crypto to Invest in 2025 [By Marktet Cap]

If you want to know which coins lead the market, you should look at their market cap. Market cap shows how much money people have put into a coin. The bigger the market cap, the more trust and attention a coin gets. You can use this list to spot the top cryptocurrencies for 2025.

Here’s a table with some of the biggest names right now. These coins have strong prices and huge market caps. You will see some familiar names and maybe a few surprises.

| Rank | Cryptocurrency | Price | Market Cap |

| 1 | Bitcoin (BTC) | $108,814.58 | $2.16T |

| 2 | Ethereum (ETH) | $3,447 | $415.29B |

| 3 | Tether (USDT) | $1.00 | $152.52B |

| 4 | XRP (XRP) | $2.35 | $137.99B |

| 5 | Solana (SOL) | $237 | $112.75B |

| 6 | Binance Coin (BNB) | $600.12 | $92.30B |

| 7 | Tron (TRX) | $0.27 | $25.70B |

| 8 | Cardano (ADA) | $8.41 | $12.80B |

| 9 | Hyperliquid (HYPE) | $34.22 | $11.43B |

| 10 | Bitcoin Cash (BCH) | $442.01 | $8.78B |

| 11 | Monero (XMR) | $400.23 | $7.38B |

| 12 | Ethena USDe (USDe) | $1.00 | $5.15B |

| 13 | VeChain (VET) | $0.04 | $3.33B |

| 14 | Stacks (STX) | $2.20 | $3.30B |

| 15 | The Graph (GRT) | $0.28 | $2.65B |

| 16 | Arweave (AR) | $9.50 | $2.38B |

| 17 | Kaspa (KAS) | $0.17 | $4.06B |

| 18 | Hedera (HBAR) | $0.07 | $2.21B |

| 19 | Injective (INJ) | $29.80 | $2.76B |

| 20 | Aptos (APT) | $11.60 | $3.11B |

You can see that Bitcoin and Ethereum still lead the pack. Tether and XRP also have huge market caps. Solana and Binance Coin keep growing fast. Some coins, like Hyperliquid and Ethena USDe, are newer but already have big numbers.

This chart gives you a quick look at how these coins stack up. You can spot which coins have the most money behind them. If you want to invest in top-performing cryptocurrencies, you should pay attention to these leaders.

Tip: Market cap is not the only thing you should check. Look at the coin’s use case, team, and how active the community is. A big market cap can mean safety, but smaller coins can grow faster.

The crypto world changes fast. New coins can rise quickly, and old favorites can fall. If you want to stay ahead, keep an eye on these top cryptocurrencies. Watch the market cap rankings every month. This way, you can spot new trends and make smarter choices.

What Factors Should You Consider in 2025’s Crypto Investing

When you want to find the best crypto to invest in 2025, you need to look at a few key things. These factors help you spot the fastest growing cryptos and avoid risky choices. Let’s break down what matters most.

Market Cap

Market cap shows how much money people have put into a coin. Bigger market cap usually means more trust and less risk. You can use market cap to compare coins and see which ones lead the pack. For example, Bitcoin and Ethereum have the largest market caps, making them some of the top-performing cryptocurrencies. A strong market cap often means the coin can handle big changes in the market.

Technology

You want to check the technology behind each coin. Good technology means faster transactions, better security, and more ways to use the coin. Some of the fastest growing cryptos use new tech like smart contracts or subnet upgrades. Coins with strong developer teams and regular updates tend to last longer and work better.

Use Case

Ask yourself, “What does this coin do?” The best crypto in 2025 will solve real problems or make life easier. Some coins help you send money fast, while others power apps or games. Coins with real-world uses usually grow faster and attract more users.

Growth Potential

Growth potential tells you how much a coin could rise in value. Look for coins with active communities, lots of new users, and big plans for the future. You might notice a shift from hype-driven tokens to projects with long-term value. Coins that keep adding new features or partnerships often have the best growth chances.

Performance

Past performance can show you how a coin reacts to market changes. You can look at price trends, network activity, and how many people use the coin. For example, Ethereum has the highest growth rates in both users and network activity. Coins that bounce back after tough times often make good picks for the future.

| Metric / Cryptocurrency | Bitcoin | Ethereum | Litecoin | Dash | Z-Cash |

| Relative Growth Rate (Nodes) | Moderate | Highest | Lower | Lower | Moderate |

| Relative Growth Rate (Edges) | Moderate | Highest | Lower | Lower | Moderate |

| Node Repetition Ratio (MTG) | Low | High | Medium | Low | High |

| Edge Repetition Ratio (MTG) | Low | High | Medium | Low | High |

Tip: Coins with high growth rates and strong networks often lead the market.

Sentiment

Sentiment means how people feel about a coin. You can check social media, news, and expert opinions. Coins with positive buzz and strong communities often become the best crypto to invest in 2025. Watch for coins that get attention from big investors or have lots of developer activity.

- You will see more money flowing into coins like Bitcoin and Ethereum, especially from big companies.

- Projects with real-world utility and strong teams stand out from the crowd.

- New sectors like AI and GameFi also bring fresh investment chances.

When you use these criteria, you can spot the best crypto to invest in 2025 and avoid coins that are all hype. Always do your own research and keep an eye on the market. This way, you can find the fastest growing cryptos and build a strong portfolio for the future.

10 Best Cryptos to Invest in July 2025

July 2025 could be a pivotal month in the crypto landscape. After strong Q2 inflows—driven by renewed institutional participation and clearer regulation—many assets are consolidating.

This often presents overlooked—and potentially lucrative—entry points. In such a climate, the goal is to favor assets with solid fundamentals, credible upgrades, and catalysts that could ignite price movement as the market gears up for Q3.

As a crypto industry expert, I’ve distilled the ten most promising cryptocurrencies for July 2025. These picks blend blue-chip stability, infrastructure innovation, and forward-looking utility. Let’s dive in together.

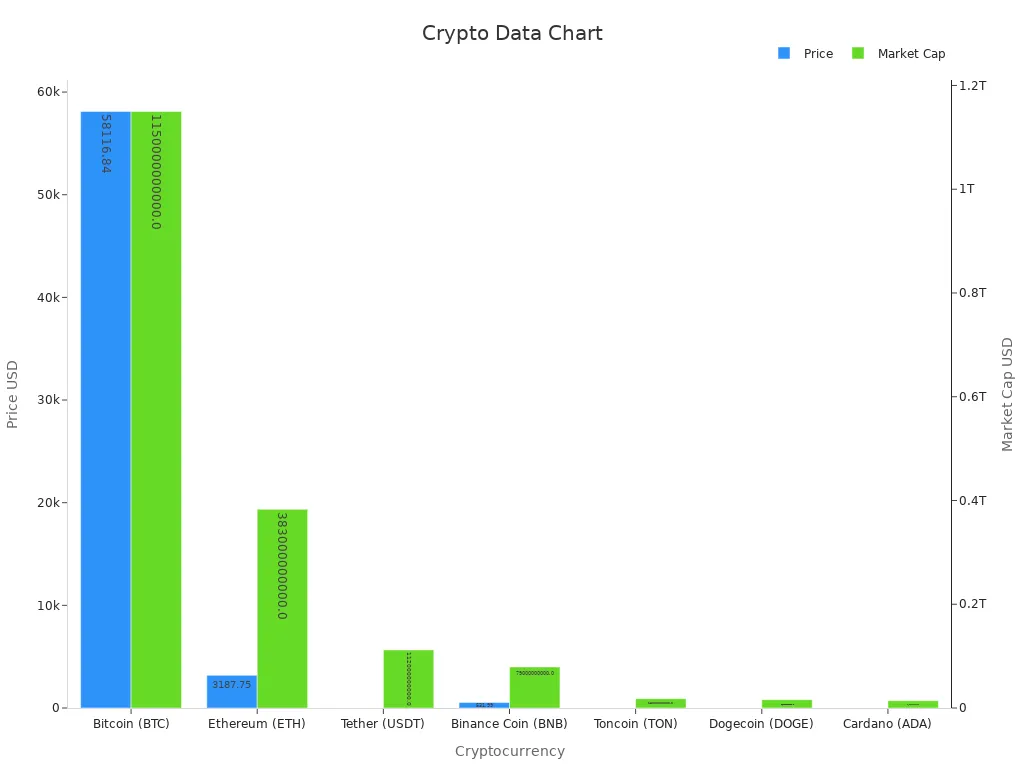

Bitcoin (BTC)

Bitcoin remains the bedrock of crypto. Beyond its digital store-of-value reputation, recent institutional adoption benchmarks signal strong momentum: US spot Bitcoin ETFs saw roughly $5.24 billion in inflows in May, while mid-tier addresses are increasingly accumulating BTC off exchanges. Additionally, corporations like MicroStrategy indirectly expose billions in equity to BTC holdings. In 2025, supportive macro factors—like a potential US strategic Bitcoin reserve—alongside cyclical dips, make July a prime time for allocation. Buy-the-dip strategies now could yield gains when institutional cycles revive in Q4.

Market Cap: ~$1.9 trillion

24h Volume: ~$48 billion

Strengths

- Bitcoin has the highest liquidity. You can buy or sell it almost anywhere, anytime.

- It is the most recognized name in crypto. People see it as “digital gold.”

- Bitcoin has a fixed supply of 21 million coins. This makes it rare and helps protect against inflation.

- Many experts believe the next halving event will push bitcoin’s price even higher.

- Bitcoin ETFs brought in $4.9 billion in early 2025, showing strong support from big investors.

Risks

- Bitcoin’s price can swing up and down very quickly. You might see big drops in a short time.

- Some countries still talk about banning or limiting bitcoin. This can cause fear in the market.

- Bitcoin uses a lot of energy for mining. Some people worry about its impact on the environment.

- Newer coins sometimes offer faster or cheaper transactions.

Recommend Reason

If you want a safe place to start, bitcoin is a smart choice. It has the biggest market cap, the most trust, and a long history of bouncing back after tough times. You can use bitcoin to balance your crypto portfolio. Many experts call it the best crypto to invest in 2025 because it leads the way for the whole market.

Tip: Bitcoin often sets the trend for other coins. When bitcoin moves, the rest of the market usually follows.

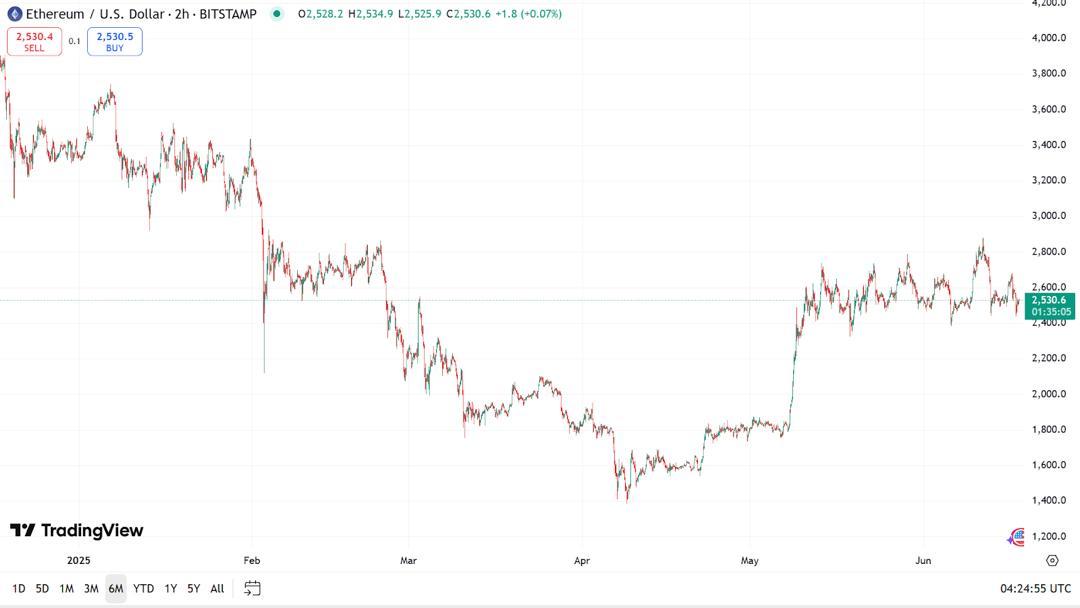

Ethereum (ETH)

Ethereum is the top smart contract platform. It lets you build apps, games, and even new coins right on its blockchain. In July 2025, ethereum trades around $3,187 with a market cap of $383 billion. After the Pectrahard fork in May 2025, ethereum became faster and easier to use. Over 28% of all ethereum is now staked, which means many people lock up their coins to help run the network and earn rewards.

Market Cap: ~$380 billion

24h Volume: ~$22 billion

Strengths

- Ethereum leads in DeFi, NFTs, and Web3 apps. Most new crypto projects start on ethereum.

- The recent upgrade made ethereum faster and cheaper to use.

- Big investors like BlackRock and Fidelity now buy ethereum ETFs. This brings more money and trust to the network.

- Staking makes ethereum more secure and gives you a way to earn passive income.

- The developer community is huge. They keep building new tools and features.

Risks

- Ethereum can get crowded. When many people use it at once, fees can go up.

- Other blockchains, like Solana, try to take users away by offering faster speeds.

- Changes to the network sometimes cause bugs or confusion.

- If you stake ethereum, your coins are locked up for a while.

Recommend Reason

You should look at ethereum if you want to join the future of digital apps and finance. It has strong growth, lots of upgrades, and support from both small users and big companies. Many experts say ethereum is the best place for new ideas in crypto. If you want more than just a store of value, ethereum gives you many ways to grow your money.

💡 Note: Ethereum’s upgrades and staking rewards make it a favorite for both long-term holders and active users.

Binance Coin (BNB)

Binance Coin, or BNB, is the main coin for the Binance exchange. Binance is the world’s largest crypto trading platform. You use BNB to pay for trading fees, join token sales, and even buy goods and services. In July 2025, BNB trades at about $532 with a market cap near $79 billion. BNB doubled in value since early 2024, showing strong growth.

Despite regulatory risks around Binance, its exchange dominance grants BNB resilience . Continued development in DeFi, GameFi, and cross-chain tools makes BNB a strong contender for mid-year accumulation.

Market Cap: ~$80 billion

24h Volume: ~$4 billion

Strengths

- BNB powers a huge ecosystem. You can use it for trading, DeFi, NFTs, and more.

- Binance burns (destroys) some BNB every quarter. This reduces supply and can help the price go up.

- The Binance Smart Chain lets you make fast and cheap transactions.

- Many new projects launch on Binance’s platform, bringing more users to BNB.

- Binance has a global reach and millions of users.

Risks

- Binance faces strict rules in some countries. If rules change, BNB’s price could drop.

- The coin depends on the success of the Binance exchange.

- If hackers attack Binance, BNB could lose value.

- Other exchanges try to copy Binance’s features.

Recommend Reason

If you want a coin with real uses and a strong team, BNB is a great pick. It grows with the Binance exchange and offers many ways to use your coins. BNB’s steady rise and big ecosystem make it a top choice for 2025. You can use BNB for trading, staking, or joining new projects.

Tip: BNB’s regular coin burns and new features help keep it in the spotlight for investors.

Solana (SOL)

You see Solana talked about a lot now. Solana is a blockchain that is fast and has low fees. In July 2025, Solana costs about $237. It is one of the top five coins by market cap. Some people call it the “Ethereum killer” because it can do thousands of transactions every second.

SOL is all about speed, with thousands of TPS and minimal fees—ideal for high-frequency use cases. The upcoming Firedancer client upgrade aims to boost throughput and reliability; it’s so promising that analysts forecast up to 150% price gains upon deployment. Furthermore, potential US spot Solana ETF filings received SEC comments in mid-June, hinting at approval timelines in July. Solana is well-positioned for a strong summer rebound.

Strengths

- Solana can do over 65,000 transactions every second. You do not have to wait long for your transaction.

- Fees on Solana are always low, even when it is busy.

- The Solana ecosystem keeps getting bigger. You see new DeFi apps, NFT markets, and games often.

- Solana uses a special proof-of-history system. This makes it different from bitcoin and ethereum.

- Big investors and companies like Solana. This brings more trust and money to the network.

Risks

- Solana has stopped working before. Sometimes, the network goes down for hours. This can make users and investors worried.

- Solana has to compete with ethereum and other smart contract platforms. If ethereum gets better, Solana could lose users.

- Some people worry Solana is not very decentralized. A few big groups control much of the network.

- New rules could change things for Solana, just like for bitcoin and ethereum.

Recommend Reason

You might want Solana if you like fast and cheap transactions. Solana’s growing developer group and ecosystem make it a good pick for 2025. If you think DeFi and NFTs will grow, Solana is a strong choice. Solana also helps you spread out your investments, not just in bitcoin and ethereum.

Tip: Watch for new upgrades and partnerships on Solana. These can help its price go up and help it compete with ethereum.

Cardano (ADA)

Cardano is known for using research and peer-reviewed tech. Cardano is in the top ten by market cap and trades at about $8.41 in July 2025.

The team has scientists and engineers who want to make a safe and big blockchain. Cardano uses proof-of-stake, so it uses less energy than bitcoin. Many people trust Cardano because it takes a meticulous, peer-reviewed approach to building its protocol, focusing on sustainability and scalability.

With the Hydra L2 solution coming online, expectations are high for its first speed and throughput improvements. Real-world partnerships—especially in Africa—are fueling both usage and ecosystem engagement. In July, as Hydra and identity initiatives roll out, ADA could reclaim momentum.

- Market Cap: ~$12 billion

- 24h Volume: ~$1 billion

Strengths

- Experts check Cardano’s technology before it is used. Every update goes through peer review.

- Proof-of-stake saves energy. Cardano is more eco-friendly than bitcoin or ethereum.

- Cardano lets you use smart contracts. You can make DeFi apps and NFTs on it.

- The Cardano community is big and active. You can find help and resources easily.

- Cardano works with governments and schools in Africa. This brings blockchain to new places.

Risks

- Cardano moves slowly. You may wait a long time for new features.

- Cardano has strong competition from ethereum, solana, and bitcoin for users.

- Some people say Cardano has not done everything it promised.

- If the team makes mistakes, people could stop trusting Cardano.

Recommend Reason

You might like Cardano if you want a blockchain that is safe and uses research. Cardano’s slow way helps stop bugs and problems. If you care about saving energy, Cardano’s proof-of-stake is a good thing. Cardano also lets you invest in a project that wants to help people all over the world.

Note: Cardano’s slow and careful way can be good for people who want less drama than bitcoin or ethereum.

Polkadot (DOT)

Polkadot links different blockchains so they can work together. In July 2025, Polkadot trades near $15 and is in the top ten by market cap. You can think of Polkadot as a bridge between networks like bitcoin, ethereum, and solana.

This makes it easier for developers to build apps that use more than one blockchain. The founder of Polkadot also helped make ethereum, so the team knows a lot.

- Market Cap: ~$9 billion

- 24h Volume: ~$400 million

Strengths

- Polkadot lets blockchains share data and assets. This helps projects grow faster.

- The network uses parachains. Each parachain can do a special job, like DeFi or gaming.

- Polkadot’s tech makes it easy to upgrade without splitting the network.

- There is a strong developer community. Many teams build new projects on Polkadot.

- The Polkadot team has lots of experience in crypto, including with ethereum.

Risks

- Polkadot has to compete with ethereum, solana, and bitcoin for users and developers.

- The technology is hard to understand. New users may find it confusing.

- If not enough projects join Polkadot, it could lose value.

- New crypto rules could change things for Polkadot, just like for bitcoin and ethereum.

Recommend Reason

You should look at Polkadot if you want to invest in a project that connects the whole crypto world. Polkadot’s focus on working together helps it stand out from bitcoin and ethereum. If you think blockchains should work together, Polkadot is a smart choice for your portfolio.

Tip: Watch for new parachain launches. These can bring more users and value to Polkadot and help it compete with ethereum and bitcoin.

Ripple (XRP)

You might know Ripple as the coin that helps banks and people send money across the world. Ripple (XRP) started in 2012. It is one of the oldest and most trusted cryptocurrencies. In July 2025, XRP trades around $2.35 and has a market cap of about $138 billion. Ripple’s main goal is to make cross-border payments fast and cheap. Many banks and payment companies use Ripple’s network to move money in seconds.

Strengths

- Speed: You can send money with XRP in just a few seconds. This is much faster than traditional banks.

- Low Fees: Sending XRP costs only a tiny fraction of a cent. You save money compared to other coins or bank wires.

- Big Partnerships: Ripple works with over 300 banks and payment providers. This gives XRP real-world use.

- Regulatory Progress: Ripple won key legal battles in 2024. This helped boost trust and price.

- Stable Network: The Ripple network almost never goes down. You can rely on it for important payments.

Risks

- Regulation: Ripple still faces some legal questions in different countries. New rules could affect XRP’s price.

- Centralization: Some people say Ripple controls too much of the XRP supply. This can worry investors who like decentralization.

- Competition: Other coins, like Stellar, also focus on fast payments. Ripple must keep improving to stay ahead.

- Market Swings: XRP’s price can jump up or down quickly. You need to be ready for changes.

Recommend Reason

You should consider XRP if you want a coin with real-world use and strong partnerships. Ripple’s focus on fast, cheap payments makes it a favorite for banks and businesses. If you believe global payments will keep growing, XRP is a smart pick for your portfolio.

Tip: Watch for new deals between Ripple and big banks. These can help XRP’s price go up fast.

Litecoin (LTC)

Litecoin is one of the oldest cryptocurrencies. It started in 2011 as a “lighter” version of Bitcoin. In July 2025, Litecoin trades near $442 and has a market cap of about $8.8 billion. People call Litecoin the “silver to Bitcoin’s gold.” You can use Litecoin for fast and cheap payments. Many stores and online shops accept it.

Strengths

- Fast Transactions: Litecoin processes blocks every 2.5 minutes. You get your money quickly.

- Low Fees: Sending Litecoin costs less than a penny. This makes it great for small payments.

- Strong History: Litecoin has worked for over a decade. It has never been hacked.

- Active Development: The team keeps adding new features, like privacy upgrades.

- Widespread Use: Many wallets and exchanges support Litecoin. You can buy, sell, or spend it almost anywhere.

Risks

- Competition: Many new coins offer fast and cheap payments. Litecoin must keep up to stay popular.

- Less Hype: Litecoin does not get as much attention as Bitcoin or Ethereum. This can slow price growth.

- Price Swings: Like other coins, Litecoin’s price can change quickly.

- No Smart Contracts: Litecoin does not support complex apps like Ethereum or Solana.

Recommend Reason

You might like Litecoin if you want a simple, safe, and fast coin. It has a long track record and low fees. Litecoin is a good choice for sending money or making everyday purchases. If you want a reliable coin that just works, Litecoin is a solid pick for 2025.

📝 Note: Litecoin often leads the way for new upgrades in crypto. Watch for new features that can boost its value.

Chainlink (LINK)

Chainlink is not just another coin. It is a network that connects smart contracts to real-world data. Chainlink started in 2017. In July 2025, LINK trades around $18 and has a market cap of about $10 billion. Many DeFi apps and blockchains use Chainlink to get trusted information, like prices or weather data.

Strengths

- Real-World Use: Chainlink brings outside data to blockchains. This lets smart contracts work with real events.

- Trusted by DeFi: Most top DeFi projects use Chainlink oracles. This makes LINK very important in crypto.

- Strong Partnerships: Chainlink works with Google, SWIFT, and many big companies.

- Secure Network: Chainlink uses many nodes to check data. This keeps information safe and accurate.

- Active Development: The team keeps adding new features, like staking and cross-chain support.

Risks

- Complex Technology: Chainlink’s system can be hard to understand. New users may find it confusing.

- Competition: Other projects try to offer similar oracle services. Chainlink must keep improving.

- Price Volatility: LINK’s price can swing up or down quickly.

- Dependence on DeFi: If DeFi slows down, Chainlink could lose some demand.

Recommend Reason

You should look at Chainlink if you want to invest in the backbone of DeFi and smart contracts. LINK powers many apps and has strong partnerships. If you believe in the future of smart contracts, Chainlink is a must-have for your portfolio.

Tip: Keep an eye on new Chainlink upgrades. Features like staking can bring more users and boost LINK’s price.

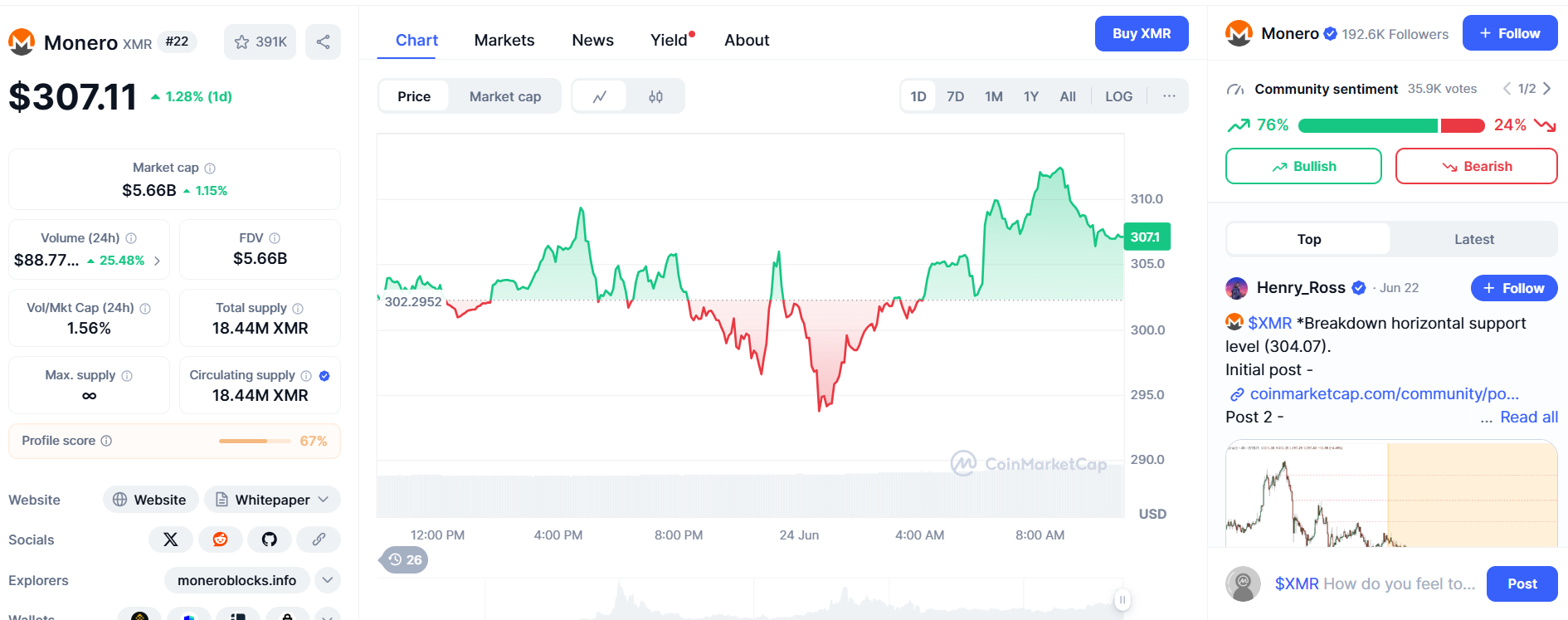

Monero (XMR)

Monero, called XMR, is the top privacy coin in crypto. Some people call it “digital cash.” Monero started in 2014. It keeps your transactions private and hidden. When you use Monero, no one can see who sent or got money. No one knows how much was sent either. In July 2025, Monero trades at about $400. It is in the top 20 by market cap. Many people pick Monero for real privacy and safety with their digital money.

Strengths

- Unmatched Privacy: Monero uses special tech like ring signatures and stealth addresses. These tools hide who you are and your transaction details. No one can track your payments.

- Fungibility: Every XMR coin is the same as any other. You do not have to worry about “tainted” coins or blacklists. Monero works just like cash.

- Active Community: Monero has a strong group of developers and users. They keep making the network better and add new features.

- Decentralization: No single person or company runs Monero. The network is open and fair for everyone.

- Real-World Use: People use Monero for private payments, donations, and shopping online. Some stores take XMR because it protects buyers and sellers.

Tip: If you care about privacy, Monero is the best choice. You can send money without leaving a digital trail.

Risks

- Regulatory Pressure: Some governments do not like privacy coins. They might ban or limit Monero. This can make it hard to buy or sell XMR on big exchanges.

- Limited Exchange Support: Not every crypto exchange lists Monero. You may need to look for a place that supports it.

- Negative Publicity: Some people link Monero to illegal things. This can hurt its reputation and price.

- Competition: Other privacy coins like Zcash or Dash try to do the same things. Monero must keep getting better to stay ahead.

| Risk Factor | Impact Level | What You Should Watch For |

| Regulation | High | News about bans or restrictions |

| Exchange Delisting | Medium | Fewer places to trade XMR |

| Public Perception | Medium | Media stories about privacy coins |

| Competing Projects | Low | New tech from rivals |

Recommend Reason

You should think about Monero if you want real privacy and control over your money. Monero hides your transactions better than any other coin. The network is strong, and the community keeps it safe and up to date. If you worry about privacy or want to avoid tracking, Monero is a smart pick for 2025. You can use it for private payments, donations, or to balance your crypto portfolio.

Note: Monero is not for everyone. If you want privacy and want to protect your digital life, XMR is the coin to watch.

Best Cheap Crypto to Buy Now for Long Term [Expert Analysis]

Are you searching for the best cheap cryptos to buy now and hold for the long-term? You are not alone. Many investors want to find coins that cost less but have big growth potential. You do not need a huge budget to start building your crypto portfolio. Some of the best long-term cryptocurrencies started out as “cheap” coins before they became household names.

Here are five of the best cheap crypto to buy now if you’re thinking long-term (2025–2030).

| Crypto | Price | Market Cap | Pros | Cons | Expert Take |

| VeChain (VET) | ~$0.035 | ~$2.5B | – Real enterprise adoption- Dual-token model (VET + VTHO) | – Centralized validators | Strong under-$0.05 choice for logistics/supply chain blockchain exposure. Used by Walmart China, BMW. |

| Hedera (HBAR) | ~$0.07 | ~$2.2B | – Blue-chip governance (Google, IBM)- Ultra-fast, low-cost | – Less decentralized than PoS | High-throughput ledger tailored for financial institutions and ID systems; scalable and enterprise-friendly. |

| Arweave (AR) | ~$9.50 | ~$630M | – One-time fee model for permanent storage- Strong Web3 integration | – Complex tokenomics | Top play in decentralized data storage; ideal for long-term NFT, archive, and academic record hosting. |

| Render (RNDR) | ~$7.20 | ~$2.8B | – High utility for AI, 3D, VR- Apple Vision Pro ties | – Still early on monetization | Poised to lead GPU-sharing economy; infrastructure for the metaverse and AI industries. |

| Kaspa (KAS) | ~$0.17 | ~$4B | – 1 block/sec speed- GPU-miner friendly PoW | – Inflation risk in tokenomics | Best bet under $0.20 for PoW believers seeking speed & scalability. Next-gen Layer 1 contender. |

When you look for the best long-term cryptocurrencies, you should use a mix of research methods. Experts often use fundamental analysis to check the value of a project. They read the whitepaper, look at the team, and see how many people use the coin. Sentiment analysis helps you understand how people feel about a coin.

You can check social media, news, and even special indexes that show if people feel greedy or scared. Technical analysis lets you spot price trends by looking at charts and patterns. On-chain analysis digs into the blockchain itself. You can see how many people use the coin, how much money moves around, and if big investors are buying or selling.

Glassnode, a top market intelligence company, works with big names like CME Group and Coinbase. They use smart tools to track how people act in the crypto market. Their reports help you see which coins have strong support from real users. This kind of data can give you an edge when picking cryptos to buy now for the long-term.

You also want to use good trading platforms. These exchanges let you buy, sell, and store your coins safely. Many of them offer tools that show you price charts, news, and even expert opinions. High liquidity on these platforms means you can trade without moving the price too much. This helps you get the best deal when you buy or sell.

Here are some tips to help you spot the best long-term cryptocurrencies that are still cheap:

- Look for coins with active teams and real-world use cases.

- Check if the coin has a growing community and strong partnerships.

- Watch for coins that keep adding new features or upgrades.

- Use trading tools and reports to track price trends and user activity.

Remember: Cheap does not always mean good. Some coins stay cheap for a reason. Always do your own research before you invest.

Long-term cryptocurrency investment is not about chasing hype. You want coins that can survive ups and downs. If you pick coins with strong teams, real use, and growing support, you give yourself a better chance for success. The best long-term cryptocurrencies often reward patient investors who stick with their plan.

How to Invest and Store Crypto in 2025: Ultimate Guide for Beginners

Are you ready to start your crypto journey? You can follow these simple steps to make your first investment and keep your coins safe. Let’s break it down so you can feel confident every step of the way.

You don’t need to be a tech expert to invest in cryptocurrency. Here’s a step-by-step guide that makes it easy for beginners:

Step 1: Choose What to Invest In

Start by picking 2–3 coins based on your goals. Want safer long-term growth? Look at Bitcoin (BTC) and Ethereum (ETH). Curious about innovation? Explore Solana (SOL), Chainlink (LINK), or VeChain (VET).

Ask yourself:

- What does the project actually do?

- Is it widely adopted?

- Is the market cap growing?

- Does it match my risk tolerance?

Step 2: Buy Crypto Through a Secure Exchange

To get started, you’ll need an account on a crypto exchange—a platform where you can buy and sell digital assets.

What to look for:

| Criteria | What It Means |

| Security | 2FA, cold storage, strong reputation |

| Low fees | Some charge high spreads or withdrawal fees—compare first |

| User-friendly | Mobile app, easy dashboard, helpful support |

| Available coins | Make sure it lists the cryptos you want |

Recommended exchanges (2025):

- Coinbase – Easy to use, strong regulation

- Binance – Low fees, great for active traders

- Kraken – Extra security features

- FastTradeWiz – Beginner-focused with built-in guides.

Several major platforms serve beginners well. But if you prefer to follow top-performing wallets and automate your trades, TradeWiz bot offers a powerful copy trading bot that analyzes smart money addresses and mirrors their moves—complete with auto-sell features, limit orders, and lightning-fast execution. It’s ideal for beginners who want results but aren’t sure how to time the market.

Tip: Start with a small amount and focus on learning. You can always add more as you get comfortable.

Step 3: Store Your Crypto in a Secure Wallet

You need a wallet to keep your crypto safe. Wallets store your private keys, which let you send and receive coins. Picking the right wallet is key for long-term safety. Here are your options:

| Hot Wallets (online/app-based) | Cold Wallets (hardware wallets) |

| E.g. MetaMask, Trust WalletEasy to use, great for small amounts and daily useGood for DeFi and Web3 apps | E.g. Ledger Nano X, TrezorKeeps your crypto offline—safe from hackersIdeal for long-term storage |

Hot vs. Cold

Hot wallets connect to the internet. They are easy to use and great for quick trades. Examples include Trust Wallet and Coinmetro. Cold wallets, like Ledger and Trezor, stay offline. They protect your coins from hackers and are best for long-term storage. Hardware wallets keep your keys safe from brute force attacks and theft. You must keep your recovery seed private. If someone gets your seed, they can take your coins without leaving a trace. Most people use cold wallets for big or long-term holdings.

Security Tips

- Always enable two-factor authentication on your exchange and wallet.

- Never store large amounts on exchanges. Move your coins to your own wallet.

- Write down your recovery seed and keep it in a safe place. Never share it online.

- Stay updated on wallet software and only download from official sites.

- Remember, hardware wallets are very secure, but you must protect them from loss or theft.

Note: The crypto market is now worth over $2.5 trillion. More people use hardware wallets, so you need to know how to keep your coins safe.

Step 4: Smart Ways to Invest

You don’t need to time the market perfectly. You just need a solid strategy:

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly (e.g., $50/week), regardless of price.

- Diversify: Don’t put everything into one coin. Build a mix—BTC, ETH, a few altcoins.

- Research before you buy: Check roadmaps, dev activity, and community sentiment.

- Track your tax obligations: Use tools like CoinTracker or Koinly to stay compliant.

Note: Only invest what you can afford to lose. Crypto can go up fast—but also down just as quickly.

Step 5: Avoid Scams and Common Beginner Mistakes

Crypto scams are everywhere. You must stay alert to protect your long-term investments. Here are some common scams and how to spot them:

| Scam Type | Description |

| Fake agencies | Scammers pretend to be exchanges or government to steal your coins. |

| Donation scams | Fraudsters ask for crypto donations for fake causes. |

| Blackmail scams | Threats to reveal secrets unless you pay in crypto. |

| Arbitrage scams | Promise profits from price gaps but send fake tokens. |

| Airdrop scams | Offer free tokens but steal your wallet info. |

| Advance-fee scams | Ask for crypto upfront with fake promises of big returns. |

| Ponzi schemes | Promise high returns but pay old investors with new money. |

| ICO scams | Fake new coin launches that disappear with your money. |

| Phishing scams | Trick you into giving up your wallet info or passwords. |

| Pump-and-dump | Hype up coins, then sell off and leave you with losses. |

| Exchange scams | Fake exchanges that steal your deposits. |

You can see from reports that crypto scams are rising fast:

- Reports to the BBB have tripled in three years.

- The FTC says people lost $750 million to crypto scams in 2021.

- The FBI got over 35,000 crypto scam complaints in 2020, with $246 million lost.

- In Canada, losses jumped from $8.3 million in 2019 to $75 million in 2021, mostly in Bitcoin.

- Most victims never report scams, so the real numbers are even higher.

Stay safe: Never trust offers that sound too good to be true. Always double-check websites and never share your wallet seed or passwords.

In addition, Many newcomers lose money by falling into traps. Here’s what to watch out for:

| What to Avoid | What to Do |

| Don’t FOMO into meme coins without doing research. | Bookmark official sites (no Google ads!) |

| Don’t store your coins only on an exchange. | Enable 2FA on all accounts. |

| Don’t click on random airdrop links or DMs on Discord/X. | Follow reliable news sources (e.g., CoinDesk, FastTradeWiz Blog). |

| Don’t share your wallet seed phrase—ever. | Practice with a small amount before scaling up. |

Step 6: Track and Grow Your Investments

Once you’ve started investing, you’ll want to monitor your portfolio and look for ways to grow your holdings safely.

Try these tools:

- CoinStats, Delta, Zerion – Great for portfolio tracking

- DeFi apps like Aave, Compound, or Lido – Earn passive income through lending or staking

- Staking ETH, SOL, or ADA can earn you 4–10% APY

Always read the fine print. Some high-yield platforms carry hidden risks.

If you want to invest in cryptocurrency for the long-term, you need to stay informed, use secure wallets, and watch out for scams. Protect your coins and your future by following these simple steps.

Crypto New Prediction: Future of Crypto in the Next 5 Years

The next five years will be transformative for crypto—not just in how people invest, but in how blockchain technology integrates into everyday life, traditional finance, and digital infrastructure. From regulatory clarity to AI-driven tools, we’re moving into a more mature, more useful, and more widely adopted era.

This expert-backed forecast brings together key trends, real-world data, and evolving sentiment across institutions and markets. Let’s explore where crypto is heading by 2030—and how you can prepare for it.

Prediction 1: Crypto Will Become Part of Traditional Finance

One of the clearest shifts we’re seeing is the integration of crypto into traditional financial systems. In early 2024, the U.S. approved spot Bitcoin ETFs, leading to more than $15 billion in institutional inflows within just a few months. BlackRock, Fidelity, and JPMorgan began rolling out blockchain-based settlement tools, while governments worldwide tested central bank digital currencies (CBDCs).

We’re no longer talking about crypto existing on the fringes. It’s becoming a key part of how money and assets move globally. Tokenized real estate, stocks, and bonds are already appearing on-chain. What was once “alternative finance” is quietly becoming infrastructure.

Prediction 2: Bitcoin Will Act Like Digital Gold

Bitcoin’s reputation has shifted. Originally designed as peer-to-peer digital cash, it has matured into a macro hedge against inflation, debt crises, and currency debasement. Its capped supply (21 million), decentralized design, and increasing adoption by public companies—like MicroStrategy and Tesla—support this shift.

ARK Invest, for example, projects a long-term BTC price range of $250,000–$1 million, especially as emerging markets explore Bitcoin as a reserve asset. With more ETFs in development and growing institutional trust, Bitcoin is likely to remain a central pillar of long-term portfolios.

Prediction 3: Ethereum Will Power the Web3 Economy

Ethereum is more than a blockchain—it’s the backbone of Web3. And with Layer 2 solutions like Arbitrum and zkSync gaining traction, Ethereum now processes more transactions at lower costs than ever before.

Upcoming upgrades like proto-danksharding (part of the Dencun update) will make Ethereum even more scalable. Developers are moving away from building new Layer 1 chains and instead building on Ethereum as a modular, secure settlement layer. In short: Ethereum is becoming the infrastructure layer for everything from decentralized finance (DeFi) to social networks.

Prediction 4: Real-World Use Cases Will Drive New Growth

The future of crypto won’t be driven only by speculation—it will be driven by functionality.

Projects like Render (RNDR) offer decentralized GPU networks that power AI model training. Arweave (AR) provides permanent file storage for everything from scientific data to NFTs. These are part of a growing sector known as DePIN (Decentralized Physical Infrastructure Networks), where blockchain replaces cloud services like AWS and Google Cloud.

These projects are no longer “early ideas”—they’re real products solving real problems, and they’ll be critical in the next internet.

Prediction 5: Regulation Will Create a More Trusted Market

As the market matures, so does regulation. The European Union’s MiCA framework is already in effect, creating clear rules for stablecoins and exchanges. In the U.S., more agencies are working toward standardizing how crypto assets are taxed, registered, and monitored.

We’re moving toward a dual-structure crypto world:

- Compliant blockchains (e.g. Base, World Chain) will serve governments and institutions.

- Permissionless blockchains (e.g. Ethereum, Monero) will drive innovation and decentralization.

Contrary to fear, this clarity is likely to unlock mainstream adoption, not slow it down.

Prediction 6:Catalysts That Could Shape the Market

Some events have the power to move the market quickly. Key catalysts include:

- Bitcoin halving (2024), which historically leads to price surges

- Spot ETF approvals and institutional inflows

- Regulatory clarity, like SEC lawsuits being dropped or new licensing frameworks

- Major IPOs (e.g., Kraken or Circle going public)

- Macro trends, including inflation, interest rates, and fiat instability

Staying informed and responsive to these triggers is essential for navigating volatility.

Expert Forecasts: What Do the Models Say?

Data modeling is improving fast. According to a recent CryptoPulse study, machine learning models have reduced average prediction error rates by over 10%. These models now provide more accurate forecasts by incorporating on-chain activity, market sentiment, and macroeconomic factors.

| Metric | Improvement (%) | What It Means |

|---|---|---|

| Mean Absolute Error | 10.4% | Price predictions are more accurate |

| Mean Squared Error | 17.2% | Fewer extreme errors in forecasts |

| Correlation (CORR) | Close to 1 | Predictions closely match real prices |

Tools like the Crypto Fear & Greed Index, moving averages, and active address counts are also helping both traders and long-term investors identify smarter entry and exit points.

Trend Signals: What to Watch

Online behavior tells us a lot. Google Trends data consistently shows that when search interest for Bitcoin or Ethereum spikes, price increases often follow, especially for large-cap coins. Smaller tokens react similarly, often with a delay of a few days.

Technical indicators like ARIMA models and neural networks are helping traders and analysts detect early signals. The bottom line: attention leads price, and those watching the right metrics will act ahead of the crowd.

The Bottom Line: Is Crypto Worth It in the Next 5 Years?

Yes—if approached strategically.

Crypto is no longer just an experiment. With institutional adoption, regulatory clarity, and real-world use cases expanding, the next five years are likely to be a period of measured, intelligent growth.

Whether you’re investing in Bitcoin for macro protection, Ethereum for infrastructure exposure, or infrastructure tokens like LINK, KAS, or RNDR, the key is to:

- Diversify intelligently

- Use reliable tools (like fastradewiz.com for tracking smart wallets and copy trading)

- Stay informed

Tip: Continue learning, monitor sentiment, and use both technical and on-chain data to guide your decisions.

Crypto isn’t just a market anymore—it’s becoming the foundation for a smarter financial and technological future. And those who understand that shift early will be best positioned for the next wave of growth.

FAQ on Best Crypto in 2025

What is the safest way to store my crypto in 2025?

You should use a hardware wallet for long-term storage. It keeps your coins offline and safe from hackers. Always write down your recovery phrase and never share it with anyone.

How much money do I need to start investing in crypto?

You can start with as little as $10. Many exchanges let you buy small amounts. Start small, learn as you go, and only invest what you can afford to lose.

Can I lose all my money in crypto?

Yes, you can lose your entire investment if prices drop or if you fall for a scam. Always research before you buy and never put in money you need for daily life.

How do I pick the best crypto for my goals?

Think about your risk level and what you want to achieve. Look at the coin’s use case, team, and community. Diversify your picks to lower your risk.

Are crypto profits taxed in the US?

Yes, the IRS treats crypto as property. You must report profits on your taxes. Keep records of your buys and sells. If you are unsure, talk to a tax expert.

What should I do if I get scammed?

Act fast. Contact your exchange and report the scam. Change your passwords right away. You can also report the scam to the FTC or local police.

Can I earn passive income with top-performing cryptocurrencies?

Yes, you can stake coins like Ethereum or use DeFi platforms to earn rewards. Always check the risks before you lock up your coins.

Is it too late to invest in crypto?

No, it’s not too late. The market keeps growing and new projects launch all the time. Start small, keep learning, and watch for new trends.

What is the best long-term cryptocurrencies?

The top long-term picks are:

- Bitcoin (BTC): Most trusted and scarce—often seen as digital gold.

- Ethereum (ETH): Powers DeFi and NFTs; strong development and upgrades.

- Solana (SOL): Fast, low fees, growing in gaming and Web3.

- Chainlink (LINK): Feeds real-world data to smart contracts—essential infrastructure.

- Polkadot (DOT): Enables cross-chain communication; great for scalability.

Tip: Focus on coins with real use cases, strong teams, and active communities.

What are a long-term cryptocurrency investment strategy?

- Diversify: Hold core assets (BTC, ETH) plus a few altcoins.

- DCA (Dollar-Cost Average): Buy small amounts regularly.

- Use cold wallets: For safety over time.

- Stay updated: Follow reliable news and upgrade cycles.

- Use smart tools: Platforms like fastradewiz.com let you copy top-performing wallets—great if you’re unsure where to start.

Conclusion

Crypto investing in 2025 isn’t just about finding the next hype coin—it’s about understanding the bigger picture. From Bitcoin’s growing role as digital gold to Ethereum powering the next wave of decentralized applications, the future of crypto is about real utility, not just speculation.

In this guide, we’ve walked through the top 10 cryptos to watch in July, the best long-term and low-cost picks, expert predictions for the next 5 years, and how to start investing safely—even if you’re brand new. Whether you’re looking to build long-term wealth or just want to get your feet wet, having a clear plan, the right tools, and up-to-date knowledge makes all the difference.

Ready to begin?

Explore smarter investing with fastradewiz.com—a beginner-friendly platform where you can copy the smartest wallets, automate trades, and grow your portfolio with confidence.

And if you want to keep learning, head over to the FastradeWiz Blog for more strategies, updates, and expert tips.

Your crypto journey starts now—invest smart, stay informed, and think long-term.