Introduction: The Rapid Rise of Crypto Exchange Development

Cryptocurrency adoption is surging worldwide, transforming how we perceive and interact with digital assets. As of 2025, over 659 million users globally participate in crypto trading, and the crypto trading platform market is valued at $27 billion, projected to grow at a 12.6% CAGR over the next decade. For entrepreneurs and enterprises, building a crypto exchange is more than a tech project—it’s a strategic business opportunity. This blog explores the essential features, future-forward trends, and key strategies for launching a successful, scalable crypto trading platform.

Core Features for Successful Crypto Exchange Development

Advanced Crypto Trading Functionalities: Spot, Margin & Futures

To stay competitive, your exchange should support different types of trades:

- Spot Trading: This is the most basic trading type—users buy or sell crypto at the current market price. It’s simple, fast, and widely used.

- Margin Trading: This feature lets users borrow funds to trade larger volumes. It’s great for advanced traders looking to amplify potential returns.

- Futures Trading: Traders can lock in a price today for a trade to happen in the future. It’s a tool for both speculation and risk management.

Adding these options can help your platform attract a wider range of traders and increase transaction volume.

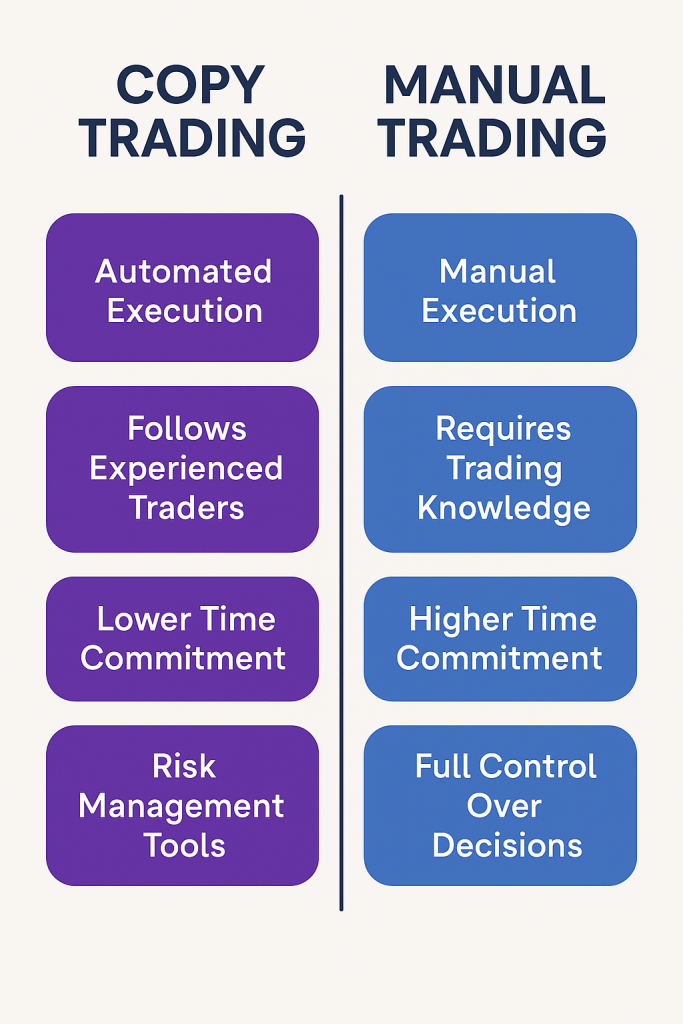

Copy Trading & Trading Bots for Enhanced User Engagement

- Copy Trading: A must-have for beginners. It allows them to mirror the trades of seasoned experts. If you’re looking for a tool to help you do this efficiently on Solana, check out TradeWiz. It’s a powerful Solana-based copy trading bot offering features like:

- Anti-MEV: Blocks MEV attacks and speeds up execution

- Auto-Sell: Automatically sells assets at your target price

- All-in-One Management: Tools to reduce risk and optimize investments

- Algorithmic Bots: These bots can automatically buy/sell based on predefined rules, removing emotional bias and making trading 24/7.

High-Performance Matching Engine & Order Execution

Your exchange is only as good as its backend. A fast and accurate matching engine ensures trades get executed without delay. If your system lags, users will notice—and they’ll leave. So invest in real-time matching and low-latency infrastructure.

Security & Compliance: Foundation of Trust in Crypto Exchange Platforms

End-to-End Security: Cold Wallets, Encryption & MFA

Security isn’t optional—it’s everything.

- Cold Wallet Storage: Keep most assets offline to prevent hacking.

- Encryption: End-to-end data protection to keep personal info and trades private.

- MFA (Multi-Factor Authentication): Adds another security layer beyond passwords.

- Regular Security Audits: Proactively scan for vulnerabilities and patch them.

You can’t build trust if your platform isn’t safe.

KYC/AML, Tax Tools & Global Compliance Strategies

Regulators worldwide are watching. So be ready:

- KYC (Know Your Customer): Automate user identity checks to prevent fraud.

- AML (Anti-Money Laundering): Monitor for unusual or suspicious transactions.

- Tax Reporting Tools: Let users download trade summaries for tax filing.

Platforms that follow global compliance standards gain credibility and attract institutional users.

User Experience & Accessibility: Mobile-First Crypto Trading Platforms

Responsive Dashboard, Mobile Apps & Real-Time Alerts

Let’s face it—everyone’s on their phone.

- Mobile Apps: Let users trade anytime, anywhere.

- Real-Time Alerts: Push notifications for price changes, order status, or system updates.

- Responsive Dashboards: Allow users to customize their view for quick decisions.

Multilingual Support, Community Forums & Ticketing Systems

- Multilingual Interface: Serve a global audience.

- Community Forums: Let users support each other and build loyalty.

- Ticketing + Chatbots: Efficient customer support 24/7.

Good UX = better retention and more trading activity.

Liquidity & Multi-Currency Support: Powering a Global Crypto Trading Experience

Trading Pairs, Stablecoins & Fiat On-Ramps

Here’s how to make your platform universally appealing:

- Multiple Trading Pairs: Offer major coins, altcoins, and tokens.

- Stablecoins: Give users a safe haven during volatile markets.

- Fiat Gateways: Let users buy/sell crypto directly using USD, EUR, etc.

Liquidity Providers & Market-Making Algorithms

Don’t forget backend liquidity:

- Partner with multiple liquidity providers.

- Add market-making algorithms to maintain order book health and price stability.

Liquidity attracts traders. Traders drive volume. Volume increases revenue.

Emerging Trends in Crypto Exchange Development (2025 and Beyond)

AI-Powered Crypto Trading Strategies & Automation

Artificial intelligence is reshaping the game:

- Predictive AI Bots: Analyze huge datasets and make fast, smart trades.

- Sentiment Analysis: Gauge market mood using social media or news data.

- Arbitrage Detection: Spot price differences across exchanges automatically.

NFT & Tokenized Asset Trading: Expanding Asset Classes

Users want more than just BTC and ETH.

- Add NFT Marketplaces for digital art, collectibles, etc.

- Enable tokenization of real-world assets like real estate or equity.

Cross-Chain Interoperability & Layer 2 Scalability

- Cross-chain Bridges: Help users move tokens between blockchains.

- Layer 2 Protocols (e.g. Polygon, Optimism): Lower fees and faster execution.

These innovations help you scale efficiently and attract sophisticated users.

Business Models & Monetization Strategies for Crypto Exchanges

Staking, Launchpads & Referral Programs

Let users—and your revenue—grow together:

- Staking Pools: Users earn while locking tokens; you earn from fees.

- Launchpads (IEO/IDO): Help new projects raise funds and generate hype.

- Referral Programs: Reward users who bring in new customers.

VIP Memberships, Subscription Models & Value-Added Services

- VIP Access: Fee discounts, exclusive listings, better support.

- Subscription Tiers: Monthly fees for premium tools and insights.

- Tax Calculators & Investment Analytics: Especially useful for high-volume or institutional traders.

Conclusion: Building a Scalable, Secure, and Future-Proof Crypto Exchange

Crypto exchange development in 2025 is about more than building a product—it’s about creating a trusted ecosystem. From TradeWiz’s Solana-native bot to AI-powered insights and decentralized interoperability, the key to long-term success lies in combining robust infrastructure with user-centric features and forward-thinking strategies.

Want to take your Solana trading to the next level? Try TradeWiz to access secure, automated copy trading built for modern crypto users.

Frequently Asked Questions (FAQs)

Q1: What are the must-have features for a modern crypto exchange platform?

A: You’ll need spot and margin trading, real-time matching, copy trading tools like TradeWiz, KYC/AML, cold wallet security, mobile access, and strong liquidity infrastructure.

Q2: How can AI and automation improve crypto trading platforms?

A: AI helps identify trends, detect arbitrage opportunities, and make emotion-free trades. It boosts efficiency and widens your platform’s appeal to both beginners and pros.

Q3: Is regulatory compliance necessary for launching a crypto exchange?

A: Absolutely. Users won’t trust your platform without compliance. Plus, meeting KYC, AML, and tax obligations helps you avoid fines and legal issues.

Q4: Have you tried a copy trading bot like TradeWiz?

If not, what’s stopping you? TradeWiz is designed for the Solana ecosystem and offers features like MEV protection, auto-sell limits, and portfolio risk management. Start here.

Q5: Which features would YOU prioritize if you built a crypto exchange today?

Would it be staking, Layer 2 speed, or an AI trading bot? Let us know in the comments!