Introduction

The cryptocurrency market has rapidly evolved over the past few years, with Solana emerging as one of the most popular and promising blockchains due to its high scalability and low transaction fees. As a result, more traders are looking for efficient ways to navigate the Solana ecosystem and capitalize on its fast-paced market. This is where a Solana trading bot comes into play. A Solana trading bot automates the process of trading on Solana, allowing traders to execute trades faster, more efficiently, and with greater precision than ever before. With the volatile nature of cryptocurrency markets, especially on platforms like Solana, having an automated tool can be a game-changer for anyone looking to optimize their trading strategy. Whether you’re an experienced trader or a beginner, a Solana trading bot provides a strategic advantage that can help improve your performance while minimizing risks.

In this guide, we’ll explore how you can use an AI trading bot, particularly TradeWiz, to enhance your Solana trading experience. We’ll also highlight key features, advantages, and how to implement an efficient trading strategy with automation.

What is Solana Trading?

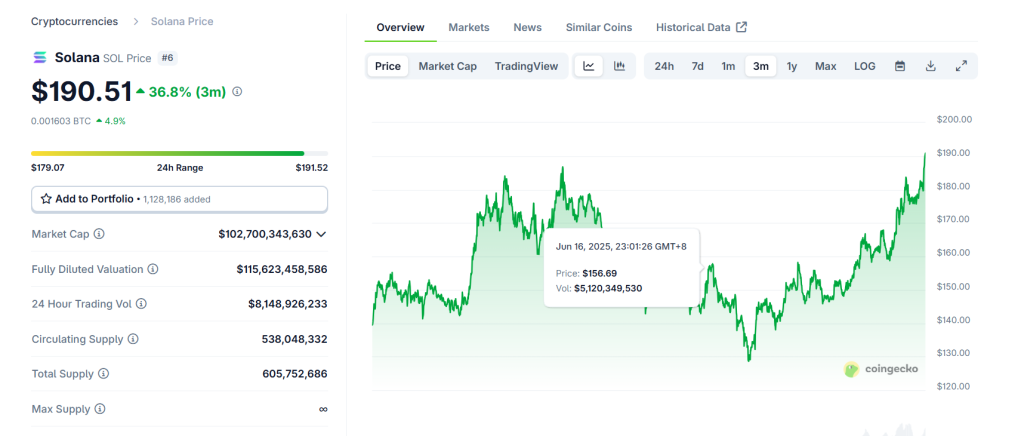

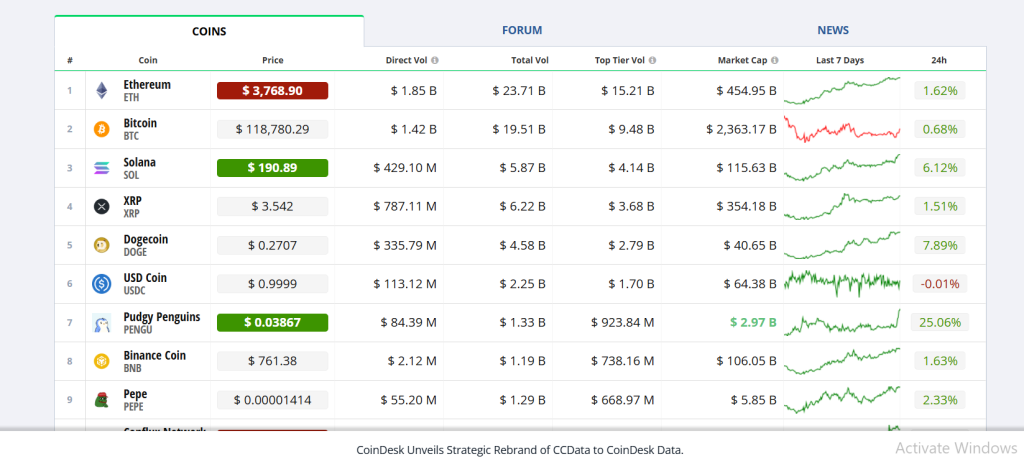

Overview of Solana (SOL)

Solana has quickly risen to prominence due to its unique consensus mechanism—Proof of History (PoH)—which allows it to handle over 50,000 transactions per second (TPS). This enables Solana-based applications and DeFi projects to scale more effectively, compared to traditional blockchains like Ethereum.

For more details, you can refer to Solana’s official website here.

Solana Trading refers to buying and selling SOL tokens or other assets built on Solana’s blockchain. Given Solana’s scalability, traders are often attracted to its low transaction fees and faster transaction speeds, making it an ideal platform for high-frequency trading.

However, the volatility and speed of Solana can be overwhelming for manual traders. This is where an AI trading bot can significantly help automate trading strategies.

Why Use an AI Trading Bot for Solana?

Benefits of AI in Cryptocurrency Trading

In a volatile market like Solana, executing trades swiftly and accurately can be the difference between profits and losses. An AI trading bot provides several key advantages:

- Speed and Efficiency: AI bots analyze market data in real-time, executing trades faster than humans can react. This is essential in volatile markets like Solana.

- 24/7 Operation: AI trading bots operate around the clock, allowing you to execute trades at any time, even while you sleep.

- Emotion-Free Trading: AI trading bots are not influenced by emotional biases, which can often lead to irrational decision-making during high-pressure situations.

The Case for Solana

With its high throughput and low fees, Solana is one of the most dynamic blockchain networks for cryptocurrency traders. The ability to complete transactions quickly means you can exploit short-term price movements effectively. However, human traders might miss opportunities due to the speed of execution or market fatigue. An AI trading bot solves this by automatically executing trades based on your pre-set strategies.

How to Trade Solana with an AI Trading Bot

Step 1: Choose the Right AI Trading Bot

When selecting a trading bot for Solana, it’s important to choose one that offers both advanced features and simplicity. TradeWiz stands out as an excellent solution for Solana traders.

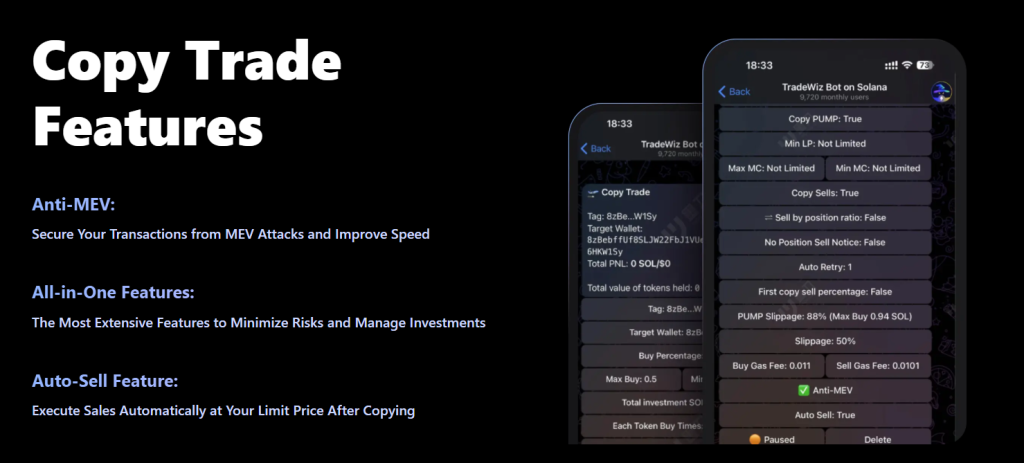

TradeWiz offers key features such as:

- AI-powered algorithms: These algorithms can analyze the market, detect trends, and execute trades based on real-time data.

- Copy Trading: This feature allows you to follow and replicate the trades of successful traders on the platform.

- Anti-MEV: Protects your transactions from MEV (Miner Extractable Value) attacks, ensuring quicker, more secure trades.

- Auto-Sell Feature: Automatically sells assets at your predefined limit price after copying successful trades, ensuring you don’t miss profit-taking opportunities.

Step 2: Setting Up Your AI Trading Bot

Once you’ve selected TradeWiz, follow these simple steps to get started:

- Create an Account: Sign up for a TradeWiz account.

- Link Your Wallet: Connect your Solana wallet to TradeWiz to facilitate secure transactions.

- Configure Trading Preferences: Set your desired risk levels, profit-taking strategies, and stop-loss orders.

- Activate the Bot: Once everything is set, activate the bot and allow it to execute trades on your behalf.

For a more detailed guide on setup, visit the official TradeWiz Gitbook.

Step 3: Monitoring and Adjusting Strategies

After your bot starts trading, keep an eye on its performance. TradeWiz offers an interactive dashboard where you can track your portfolio, view trade history, and adjust settings as needed. You can tweak risk tolerance, change strategies, or stop the bot if necessary.

Advantages of Using a Solana Trading Bot

Here are the key advantages of using a Solana trading bot, with insights from various sources to give you a comprehensive understanding.

1. Speed and Efficiency in Trade Execution

One of the main advantages of using a Solana trading bot is the ability to execute trades much faster than human traders can manually. Solana’s blockchain is designed for high-speed transactions, processing thousands of transactions per second (TPS). For traders, speed is essential, especially in a market where prices can change in fractions of a second.

- Real-time Execution: AI trading bots like TradeWiz leverage real-time data analytics and execute orders immediately when favorable market conditions arise. This reduces the latency involved in human decision-making and ensures that the trades happen at the best possible prices.

- Minimizing Slippage: Slippage occurs when there is a difference between the expected price of a trade and the actual price at which the trade is executed. With a bot handling trades, this risk is greatly minimized as the bot can execute trades swiftly without delay.

2. 24/7 Trading: Round-the-Clock Availability

Another major advantage of using a Solana trading bot is its 24/7 availability. The cryptocurrency market never sleeps, and opportunities can arise at any hour. A Solana trading bot ensures that you never miss a profitable trade, even if you are asleep, on vacation, or simply unavailable for manual trading.

- Always Active: Since Solana operates continuously without downtime, it is crucial to have a trading solution that can keep up. Bots can operate tirelessly, scanning the market for trading opportunities and executing orders based on predefined criteria. This continuous trading capability is something human traders cannot match.

- No Time Zone Concerns: The global nature of cryptocurrency markets means they are active across multiple time zones. Crypto bots like TradeWiz can adjust their trading schedules based on global market trends, ensuring that your trades are executed at optimal times without needing to monitor the markets continuously.

3. Emotion-Free Trading

Human emotions, such as fear, greed, and panic, can often cloud judgment and lead to suboptimal trading decisions. These emotions are particularly powerful in the high-risk environment of cryptocurrency trading. A trading bot, however, operates strictly on data and logic, removing the emotional aspect from trading.

- Avoiding Emotional Biases: AI trading bots like TradeWiz follow algorithms and programmed rules, meaning they don’t deviate from a strategy based on feelings. For instance, a trader may panic and exit a position too early during a market downturn, missing out on a potential rebound. A bot would simply follow its rules, ensuring consistency.

- Minimizing Risk of Overtrading: Traders often make the mistake of overtrading in a volatile market, chasing profits in an erratic way. Bots, on the other hand, stick to predefined strategies, reducing the temptation to make impulsive trades.

This emotionless approach ensures that your trading strategy is implemented consistently, which is especially important when trading on fast-moving blockchains like Solana.

4. Backtesting and Strategy Optimization

One of the most valuable features of using a Solana trading bot is the ability to backtest your trading strategies. Backtesting allows traders to assess how a strategy would have performed in the past using historical market data.

- Improved Strategy Validation: With tools like TradeWiz, you can backtest different algorithms against past market data to ensure your strategy works before risking real capital. This helps in fine-tuning strategies and adjusting parameters like stop-loss levels, take-profit targets, and trade frequency.

- Data-Driven Decision Making: By leveraging historical data, bots can improve their decision-making process. They can optimize trading strategies based on past performance and market conditions, helping to maximize profitability while reducing potential risks.

5. Risk Management and Customizable Settings

Risk management is a critical component of successful trading, especially in the volatile crypto space. Solana’s speed and scalability can create large price fluctuations, making it essential to have robust risk controls in place. Trading bots offer a variety of customizable risk management features that allow you to protect your investments.

- Stop-Loss and Take-Profit: TradeWiz allows users to set automatic stop-loss orders to limit losses if a trade moves against them. Similarly, take-profit orders can be used to lock in profits once a trade reaches a predetermined level.

- Position Sizing: Bots can automatically adjust the size of each trade based on the total portfolio value, ensuring that no single trade will expose you to excessive risk. This prevents over-leveraging, which is a common problem in high-volatility environments like Solana.

- Auto-Sell Feature: Bots can automatically execute the sale of a coin once it reaches a predetermined price, reducing the potential for missed profits due to human delay. TradeWiz‘s auto-sell feature ensures that profits are locked in, even during rapid price fluctuations.

6. Increased Efficiency and Reduced Human Error

Human traders can often make mistakes due to fatigue, inexperience, or simply miscalculating market conditions. These errors can lead to missed opportunities or significant financial losses. Trading bots are highly efficient in performing multiple tasks simultaneously without the risk of errors.

- Multi-Tasking: TradeWiz can execute multiple strategies across various markets, adjusting trades on different Solana pairs or even different cryptocurrencies at the same time. This capability maximizes efficiency, something no human can achieve.

- Minimized Error: Bots follow their programmed instructions precisely, eliminating mistakes that can occur due to lack of focus, distractions, or misjudgment. This consistency makes bots far more reliable than human traders.

- Real-Time Data Monitoring: Bots continuously monitor market data, including order books, liquidity, and price trends, without taking breaks. This ensures you are always up to date with the latest developments in the market, something that is difficult for manual traders to manage effectively.

7. Cost-Effective Solution for Trading

While there are costs associated with using trading bots, they can often prove to be more cost-effective in the long run compared to hiring a professional trading team or spending endless hours monitoring the markets manually.

- Affordable Alternatives: Platforms like TradeWiz offer a cost-effective solution for traders who want to automate their strategies. These bots save time and reduce the need for hiring expensive trading consultants or teams.

- Scalable: Trading bots can easily handle increased trading volume without any extra costs, making them more scalable than human traders.

Safe Trading Strategies with AI Bots

1. Risk Management and Stop-Loss Features

The ability to set stop-loss orders is one of the primary advantages of using an AI trading bot. This helps you minimize your losses in case the market turns against your position. TradeWiz allows you to set a stop-loss and take-profit order to ensure you’re protected during unexpected market shifts.

2. Diversify Your Portfolio

Diversification is a key strategy in reducing trading risks. Don’t put all your assets into one trade or one coin. With TradeWiz, you can diversify your trades across multiple assets in the Solana ecosystem, including SOL, DeFi tokens, or NFT projects on Solana.

3. Backtest Your Trading Strategy

Before committing real capital, backtest your strategy on historical data. This allows you to see how your AI trading bot would have performed in the past, giving you more confidence before going live with your strategy.

Conclusion

Trading Solana presents huge potential, but the market’s volatility requires careful strategy and speed. By leveraging an AI trading bot like TradeWiz, you can automate your trading, eliminate human errors, and make more informed decisions in a fraction of the time it would take to trade manually. Whether you’re a beginner or an experienced trader, an AI trading bot can help you maximize your profits and minimize risks in the ever-evolving crypto world.

FAQs ABOUT AI TRADING BOT

1. What is the best AI trading bot for Solana?

For Solana traders, TradeWiz is an excellent option. Its AI-driven algorithms ensure fast and efficient trading while its advanced features provide high-level security.

2. Is using an AI bot safe for Solana trading?

Yes, TradeWiz integrates advanced security features, such as Anti-MEV protection, to secure your transactions from attacks and ensure your trades are executed safely.

3. Can I use an AI trading bot for other cryptocurrencies?

Absolutely! While TradeWiz is a great choice for Solana trading, the platform supports multiple cryptocurrencies, allowing you to trade across various blockchain ecosystems.

References

- Solana Official Website: https://solana.com

- TradeWiz Gitbook: https://tradewiz.gitbook.io/tradewiz

- CoinGecko: https://www.coingecko.com/en/coins/solana

- Messari: https://messari.io/asset/solana

The post does a great job highlighting how Solana’s low fees and high throughput make it an ideal environment for AI trading bots. One aspect I’d be curious to hear more about is how these bots adapt to sudden market volatility—especially with Solana’s rapid block times. Are there any best practices for bot configuration during periods of extreme price swings?

Thank you for your thoughtful question! I will dive into this in a later post.