Introduction

Solana Price Prediction 2025: Will SOL Reach $250–$300?

Solana (SOL) remains a standout among Layer‑1 blockchains thanks to its high throughput, minimal fees, and rapidly growing DeFi and NFT ecosystem. But as we approach mid‑2025, questions abound: Can SOL breach $200, $250, or even break into the $300+ range? Or will regulatory, technical, and competitive factors drag it back?

This article introduces Solana Price Prediction by combining technical analysis, ecosystem updates, expert predictions, and competitive insights—including a spotlight on competitors like Remittix—to give you a full 360° view. We also include TradeWiz, a Solana copy‑trading bot, as a practical tool for navigating potential price swings with automation.

Solana Price in Mid‑2025: Market Snapshot 🧭

Current price estimates place SOL between $185–$197, depending on the platform. Recent pullback followed a local peak of $208.60 in late July, retreating into the $185–$190 zone as traders consolidated profits.

As of now:

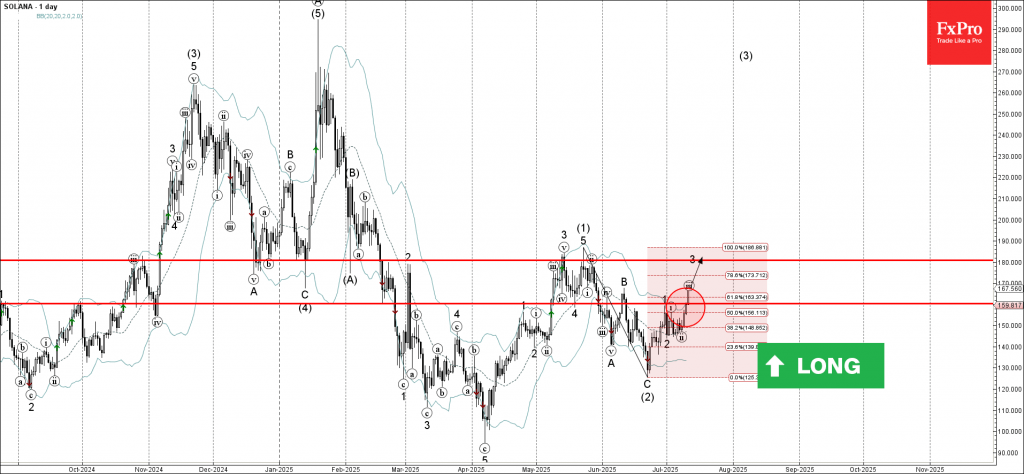

- Resistance zone: ~$188–$190 (20‑day EMA, prior highs)

- Support levels: primary near $183, with deeper support at $175–$180 and lower zone $153–$143 during volatility

New pivot data also highlights resistance around $189.41–$192.35, per traders’ cheat sheets

Technical Analysis on Solana Price Prediction

Support & Resistance Overview

| Level | Zone | Interpretation |

|---|---|---|

| $183–$185 | Short-term support | Recent bounce zone, validated by RSI/EMA alignment bitcoinsensus.com+10FX Leaders+10en.bitcoinsistemi.com+10 |

| $175–$180 | Deeper support | Critical consolidation area; breach could trigger retest of $153–$143 cryptonews.com |

| $188–$190 | Near-term resistance | 20‑day EMA and prior peaks; tests ongoing TECHicryptonews.com |

| $200–$205 | Major resistance | Clearing above $200 opens path to $250+ cryptorank.ioAInvestcryptonews.com |

| $260–$300 | Bull target zone | Tech models predict this range if breakout occurs cryptonews.comCrypto Economy |

Chart Patterns & Technical Indicators

Technical models report ascending triangle and rounded-bottom formations, bullish shapes that could fuel a rally toward $260–$350 in 2025. Volume surges and improved sentiment indicators further support this hypothesis.

Recent analysis also indicates that breaking the $188 resistance zone would be a key trigger for upside acceleration—and the momentum is trending toward that threshold.

Yet, caution: failure to hold $175 support may initiate a deeper correction toward $162 or even $143–$153 zones.

Catalysts Driving Solana’s 2025 Price

✅ Firedancer & Alpenglow Upgrades

Upgrades such as Alpenglow (150ms block finality) and Firedancer (Jump Crypto validator client) are set to improve Solana’s throughput, reliability, and reduce outages—with targets of 1 million+ TPS by late 2025.

✅ ETF & Institutional Interest

Speculation over a potential Solana ETF and institutional backing from firms like ARK Invest and Digital Asset Rev Fund reinforces bullish sentiment. Analysts believe that institutional entry could push SOL toward $250–$300 territory.

✅ DeFi & NFT Ecosystem Growth

Solana-based DEXs reported significant trading volumes, with $97B in December 2024, surpassing Ethereum’s $74B, indicating strong traction for defi activity.

✅ Competition & Utility-Focused Projects

Projects like Remittix (RTX) are drawing attention by offering real-world utility: cross-border crypto-to-fiat transfers, CertiK-audited contracts, and a beta wallet slated for Q3 2025. Remittix has already raised over $17M in presale, raising concerns of capital diversion from Solana if adoption spikes.

Competitive Landscape: Remittix vs Solana

Remittix is positioning itself as a fast-growing “PayFi” platform targeting freelancers and cross-border payments. With a Q3 2025 beta wallet supporting crypto-to-bank conversions in 30+ countries, and compatibility with multiple chains, the project is drawing investor interest away from speculative meme coins and toward utility-driven infrastructure projects.

Analysts suggest Remittix may deliver 10x–50x returns, which could influence investor preference in the broader Solana ecosystem

Nevertheless, Solana retains scale advantages and DeFi dominance worth billions in TVL. Future governance and ecosystem expansion are key to retaining its lead.

Solana Price Predictions: Conservative to Ultra‑Bullish

💼 Conservative Case

- $160–$180: In case of regulatory delays, major bug/forging events, or failure in upgrades.

- Support breach down to $153–$143 could signal deeper downside

🟢 Moderate/Neutral Outlook

- $195–$230: Based on current technical momentum, upcoming upgrades, and steady DeFi growth. Analysts commonly assign SOL a $195 average estimate for 2025

🚀 Bullish / Ultra‑Bullish Scenario

- $250–$300+: If institutional inflows, ETF approval, and Firedancer rollouts align, many technicans forecast SOL can break through resistance toward $260–$350. Some stretch models even project $400 or more in ideal conditions

Risk Factors & Worst‑Case Scenarios

⚠️ Regulatory Drag

Unresolved SEC lawsuits—including claims SOL may be a security—could block ETF approval and scare off institutional investors

⚠️ Technical Vulnerabilities

Solana has suffered multiple network outages in the past. Until stability improves and validator diversity increases, further disruptions could hurt investor confidence

⚠️ On‑chain Sentiment Shifts

Long-term holder activity has recently spiked, while new wallet growth declined, signaling waning retail enthusiasm. This could lead to price consolidations or corrections if sentiment cools further

⚠️ Competitive Pressures

As Remittix, Base, and other Layer‑1/Layer‑2 platforms grow utility-based adoption, capital may flow away from speculative platforms without real use cases

Investor Tips: Strategies for 2025 on SOL Forecast

- Monitor Daily/Weekly charts around the $188 resistance and $180–$183 support zones.

- Use tools like TradingView or exchange charting to track EMA crossovers, RSI behavior, and volume spikes.

- Keep abreast of project developments: Firedancer rollout, ETF filings, and DeFi platforms growing liquidity.

- Watch on-chain metrics: wallet growth, staking engagement, distribution concentration, Remittix presale trends.

- Prepare for volatility by using stop-loss strategies, risk sizing, and diversification.

TradeWiz: Automating Your Solana Trading

As SOL approaches critical technical zones, trading decisions become more frequent and emotionally taxing. That’s where TradeWiz comes in—a Solana copy‑trading bot designed for automation and risk control:

- ✅ Anti‑MEV Protection: Shields your trades from frontrunning and sandwich attacks while improving execution speed

- ✅ All‑in‑One Risk Tools: Manage trade sizes, stop‑losses, and exposure automatically.

- ✅ Auto‑Sell Feature: Automatically exits positions at your predetermined limit price immediately after copying a trade.

To get started, visit their official user guide, set up your Telegram wallet, and start copy trading with advanced automation features. TradeWiz offers a convenient way to implement strategy amid key price zones and technical breakouts.

Summary Forecast Table on SOL Forecast

| Scenario | Expected Price Range | Key Catalysts / Risks |

|---|---|---|

| Conservative | $160–$180 | Regulatory setbacks, macro volatility, failed upgrades |

| Moderate / Base Case | $195–$230 | Tech momentum, Firedancer, ETF speculation, DeFi growth |

| Bullish | $250–$300 | Institutional influx, ETF approval, breakout above $200 |

| Ultra‑Bullish | $300–$400+ | Cross-cycle bull market, rising adoption, consistent performance |

Conclusion

Solana is navigating a pivotal phase in 2025. With foundational upgrades, rising ecosystem adoption, and potential institutional entry, the stage is set for a breakout—but only if resistance at $188–$200 is overcome.

Investors should weigh price projections carefully—from $160 at worst, through $200+ moderate targets, to $300+ in bullish scenarios. Watch on-chain signals, regulatory news, and upgrade rollouts closely.

And when technical levels matter, tools like TradeWiz can help automate decision-making and manage risk more effectively, especially in volatile markets.

Frequently Asked Questions About SOL Forecast

1. Can Solana hit $300 by August 2025?

Yes, analysts forecast a possible surge toward $300 if Firedancer and ETF developments materialize while resistance around $200 is broken

2. Is $250 realistic in 2025?

A break above $200 with continued ecosystem momentum makes $250 plausible as a rational mid-year target.

3. What factors could bring SOL down to $150–$160?

Regulatory delays, network outages, weaker retail activity, and rising competition could trigger deeper downside.

4. What sets Remittix apart from other Solana projects?

Remittix focuses on real-world crypto-to-fiat payments, has completed security audits, and plans wallet rollout in Q3 2025—positioning it as a “PayFi” contender

5. How can TradeWiz help me trade SOL more efficiently?

TradeWiz provides anti‑MEV protection, automatic risk management tools, and auto-sell capabilities, ideal for executing timely trades amid key zones as outlined above.

It’s interesting how Solana has managed to grow its DeFi and NFT sectors so quickly while maintaining low fees. If they continue this trajectory, it’s possible they could hit $250–$300, but competition like Remittix might create some headwinds.